(Bloomberg) — Speculative fever in the cryptocurrency market is waning as the path to U.S. monetary easing becomes more difficult.

Most Read Articles on Bloomberg

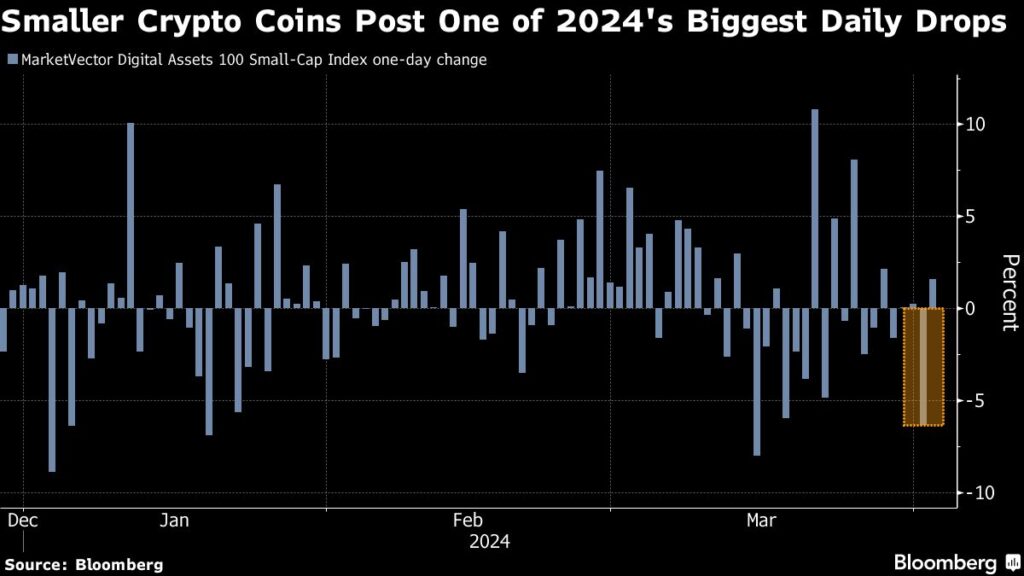

Coins previously favored by meme trading groups such as Pepe, dogwifhat and Bonk have fallen over the past 24 hours, with a benchmark for small digital assets suffering its biggest decline in more than two weeks on Monday.

The pullback adds to signs that the crypto rally, including Bitcoin's surge to record highs, is losing momentum in April. A more cautious mood is evident across global markets as U.S. price pressures linger, with investors cutting back on bets on the Federal Reserve's accommodative monetary settings.

The prospect of a narrower Fed rate cut “has an impact across cryptocurrencies, with declines seen as the week begins. No sector is immune, especially those whose prices have outperformed Bitcoin over the past six months, such as Meme,” said Stefan von Henisch, head of trading at OSL SG Pte in Singapore.

Bitcoin has fallen about 6% since hitting a high of $73,798 in mid-March. Massive inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) are starting to subside, weighing on the largest digital asset.

The supply of new Bitcoin tokens is set to be halved this month, a once-in-four-year event that some traders see as a boost to the original cryptocurrency.

Bitcoin was trading at $69,420 as of 9:58 a.m. Tuesday in Singapore, down about 1.5% from the previous trading session in the United States.

The index of top 100 digital tokens rose 61% from January to March, its biggest gain since the same period in 2021. Investors are now expecting the Fed to cut interest rates less, pushing Treasury yields and the dollar higher, but that backdrop is creating a hurdle for speculative markets. Cryptocurrency etc.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP