A version of this article first appeared in CNN Business' Before the Bell newsletter.Not a subscriber? You can sign up here it is. You can listen to the audio version of the newsletter by clicking on the same link.

new york

CNN

—

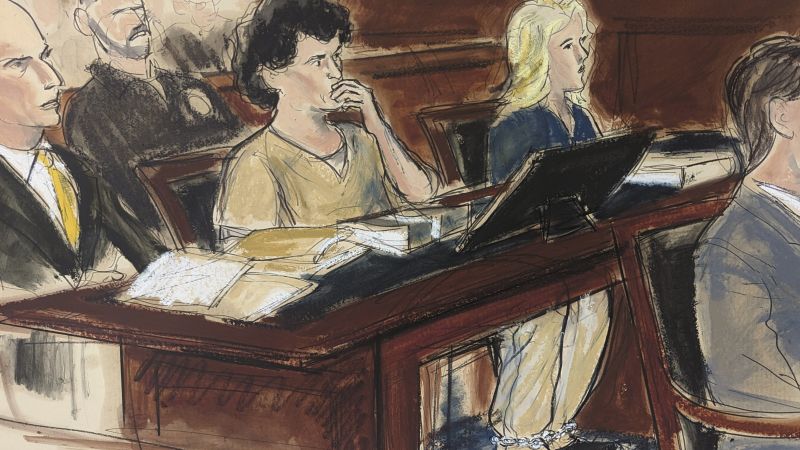

Sam Bankman Fried was sentenced last week to 25 years in prison for defrauding customers and investors at the bankrupt cryptocurrency exchange FTX. He was also ordered to repay more than $11 billion, a judgment that could potentially leave him financially incapacitated for the rest of his life.

Securing compensation for victims of such white-collar crimes can take years. Still, that's what Zach Bruch is trying to do.

Mr. Bruch is one of FTX's largest private creditors and has been selected by the U.S. Department of Justice as one of nine members of the FTX Creditors Committee, which is working to recover lost funds for customers.

According to the agency, creditor committees appointed by the Department of Justice typically consist of individuals and companies that hold seven major unsecured claims against the debtor, in this case FTX.

Bruch, a veteran of the cryptocurrency industry, also publicly debuted his startup cryptocurrency casino last week. MyPrize is valued at his $140 million and has received investments from Dragonfly, Mechanism Capital, Arrington Capital, and a16z Scout.

Before Bell talks about Bruch and Sam Bankman Fried, FTX, MyPrize, and the future of cryptocurrencies.

This interview has been edited for length and clarity.

Before the bell: Sam Bankman Freed was sentenced last week to 25 years in prison. Do you feel justice has been served?

Zach Bruch: [More than one million] People were affected financially, emotionally, and otherwise by Sam's actions. No amount of years can make up for it. I feel sorry for all the creditors and I am doing everything in my power to get back what was taken from me.

How did the collapse of FTX affect you?

That day it was a huge root canal, multiple root canals. When I got home, I was in so much pain that I couldn't even make a sound. Then I got a call and they said, “I think you're having withdrawal issues with FTX, so you should try and see if you can withdraw your money.” I immediately stumbled over to the computer, my mouth hurting, and tried to pull my hand away. Of course nothing could be extracted.

I took immediate action and called my lawyer to see if there was anything I could do. But there was nothing to do. As with any trade, we understood there were risks and we knew we needed to move forward. I needed to ensure the best possible recovery, not only for myself, but also for all of my creditors. So when the Department of Justice asked me to serve on the FTX Creditors Committee, I knew that was what I wanted to do. I want to do everything I can to get the best possible recovery for all my creditors and to make sure I can get everyone back on track.

Sam Bankman Freed's defense has been talked about claiming that FTX customers' losses are “zero,” but that means the estate is confident it can make its customers whole. It is from. How do you respond to that?

From my own perspective, the goal is to ensure that all customers get back everything they lost in the exchange. But you can't get back the time or the suffering and pain your customers may have felt. Because no matter what their financial situation is, they are victims. Everyone who was robbed was a victim, and something terrible happened to them.

Bitcoin recently surpassed the $70,000 level, Some analysts have raised their price target to $83,000. Is crypto winter officially over? What's next?

When I think about the broader crypto market, I'm thinking beyond just two weeks or six months. I have been in this field since his 2010 and have seen great growth in this industry. I think more and more people are going to get involved, more and more people are going to see the value of cryptocurrencies, see the value in it, and get exposed to this space.

Please tell us about your new online gambling venture MyPrize. Are you a gambler yourself?

I'm definitely a big risk taker. After working at some of the world's largest crypto trading desks, I started trading capital books on my own and grew to become one of the largest individual crypto traders. I've always been building this risk management space. So he looked at the gambling and gaming industry more broadly and found that it's a $1 trillion market, with less than $100 billion sitting online.

There are many similarities to crypto exchanges and trading desks, so I was confident that myself and my team could work together to build a really compelling product. You need to manage your risks appropriately, have user accounts, and consider money laundering and fraud risks and compliance. These are all things we have done in a highly biased industry like cryptocurrencies. Gambling has a similar stigma.

I think there will be a lot more online gambling in the next 3-5 years.

The latest U.S. inflation report shows that rising prices continue to weigh on U.S. consumers, my colleague Elizabeth Buchwald reports.

The Federal Reserve's preferred measure of inflation, the Personal Consumption Expenditure Price Index, rose 2.5% in the 12 months through February, faster than the 2.4% rise in January. However, this was in line with the FactSet consensus prediction.

The annual rise in inflation was driven by a 2.3% rise in energy prices last month.

Commerce Department figures released Friday mean the Fed is further away from hitting its 2% inflation target. But Fed Chairman Jerome Powell wasn't worried about that.

Powell said Friday at an event hosted by the San Francisco Fed that the numbers were “very much in line with our expectations.” He added that it is generally a good thing if the data matches the central bank's forecasts.

The latest inflation numbers are unlikely to change the Fed's plans to eventually cut rates.

Central bankers, including Mr. Powell, have signaled that reaching 2% inflation will be a difficult journey.

Federal Reserve President Christopher Waller emphasized this point earlier this week in a speech titled “There's no need to rush yet.''

He said recent inflation measurements show that “to keep inflation on a sustainable trajectory towards 2%, we will likely need to keep rates at their current restrictive level for longer than previously thought.” It would be wise to maintain this stance.”

Fed officials continued to consider three rate cuts this year. Investors expect the first of these three to appear in June.

This week, on the eve of the anniversary of the detention of American reporter Evan Gershkovich in the city of Yekaterinburg, six journalists working for independent Russian media were arrested in just a few hours, CNN colleague Radina said. Zhigova, Anna Chernova and Olesya reported. Dmitrakova.

Reporters Without Borders (RSF) said on Thursday that the journalists include Antonina Favorskaya, who covered late Russian opposition leader Alexei Navalny.

Favorskaya, who works for the independent Russian media outlet SOTA Vision, is accused of “extremist activity” for her coverage of Navalny and his activities, the press freedom group said in a statement.

On Friday, Gershkovitch reached a grim milestone: one year in Russian detention. Shortly after his arrest, the Wall Street Journal reporter was charged with espionage, a charge vehemently denied by Mr. Gershkovic, his employer, and the U.S. government.

He was the first journalist arrested on such charges since the Cold War, but the Russian government has yet to provide evidence to support the claim.