For the uninitiated, it may seem like a good idea (and an attractive prospect) to buy companies that tell investors a good story, even if they don't currently have a track record of revenue or profits. But in reality, if a company loses money every year over a long period of time, investors usually end up paying some of the losses. Because loss-making companies are always in a race against time to achieve financial sustainability, investors in these companies may be taking on more risk than necessary.

So if this idea of high risk and high reward doesn't suit you, you might be more interested in profitable growth companies such as: Kafuku Education Group (NASDAQ:WAFU). Profit is not the only metric to consider when investing, but it is worth evaluating companies that can consistently generate profits.

Check out our latest analysis for Wah Fu Education Group.

How fast is Wah Fu Education Group growing its earnings per share?

Over the past three years, Wah Fu Education Group's earnings per share have increased. So it's a bit disingenuous to use these numbers to try to derive long-term estimates. As a result, we will instead focus on last year's growth. Wah Fu Education Group last year raised his EPS for trailing twelve months from US$0.17 to US$0.21. This equates to an increase of 23%. This is a number that makes shareholders happy.

To reassess the quality of a company's growth, it's often useful to look at its earnings before interest and tax (EBIT) margin, as well as its revenue growth. In fact, Wah Fu Education Group's EBIT margin improved by 9.7 points to 19% in the last year, but on the other hand, its revenue decreased by 6.8%. That's less than ideal.

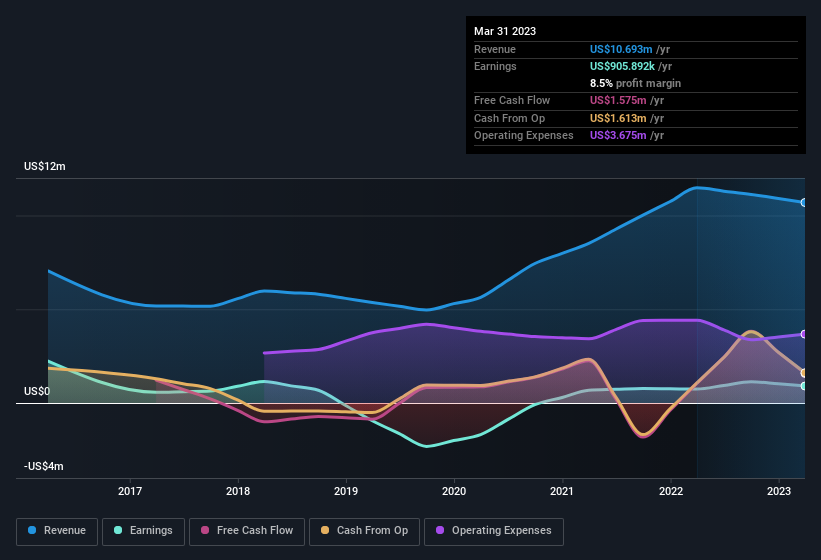

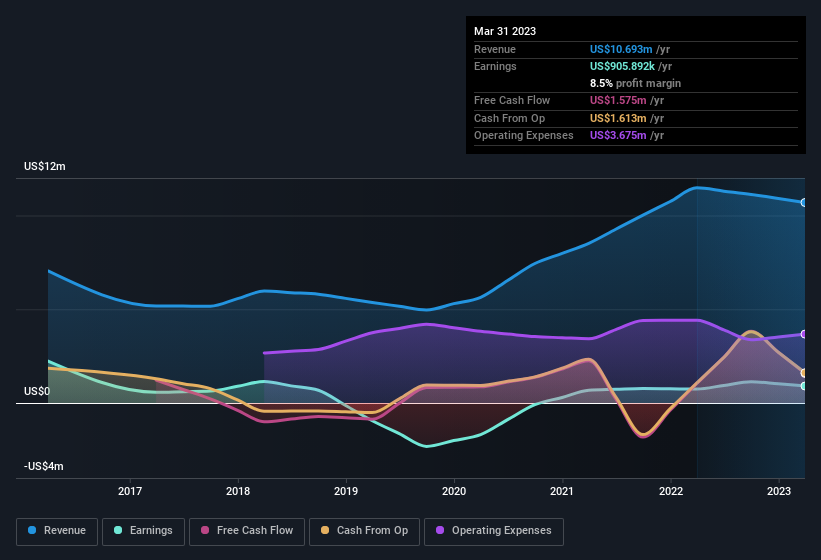

In the graph below, you can see how the company has grown its revenue and revenue over time. Click on the image for more detailed information.

Wah Fu Education Group isn't that big of a company, considering it has a market capitalization of US$8.6m. Therefore, it is very important to check the strength of the balance sheet.

Are Wah Fu Education Group insiders aligned with all shareholders?

It's often a good sign to see insiders own a majority of outstanding shares. Their incentives are aligned with investors and there is less chance of a sudden sell-off that would affect the stock price. So anyone interested in Wah Fu Education Group will be happy to know that insiders believe they own a majority of the company's shares. In fact, they own 65% of the company, so they will share the same joys and challenges that ordinary shareholders experience. This should be seen as a good thing, because it means insiders have a personal interest in delivering the best outcome for shareholders. However, Wah Fu Education Group is valued at US$8.6m, so this is a smaller company we're talking about. So despite a large proportionate holding, insiders say he only owns US$5.6m worth of shares. This isn't a big stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Wah Fu Education Group worth watching?

One good thing for Wah Fu Education Group is that its EPS is growing. That makes me happy. For those looking for more, the high level of insider ownership fuels our enthusiasm for this growth. The combination is very attractive. Yes, we think this stock is worth watching. For example, Wah Fu Education Group needs to be aware of risks. two warning signs (and #1 is a little off-putting) but I think you should know.

While picking stocks with no growth in earnings and no insider buying can still yield results, for investors who value these important metrics, we offer a combination of promising growth potential and insider confidence. Below is a selected list of US companies with .

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.