In the first quarter of this year, the cryptocurrency industry lost $336.3 million to hacks, a decrease of 23.1% from last year.

According to a report by Immunefi, in the first three months of 2024, crypto projects lost more than $321 million due to 46 hacks and 15 fraud cases.

Decentralized finance (defi) is the main target of hackers and accounts for 100% of losses in the cryptocurrency industry. According to Immunefi CEO Mitchell Amador, defi suffers from frequent compromises of private keys.

“In particular, the ecosystem is experiencing significant losses due to private key compromise, highlighting the critical need to protect both code and protocol infrastructure.”

Mitchell Amador, Founder and CEO of Immunefi

The number of hacker attacks in the first quarter of 2024 decreased by 17.5% compared to the same period in 2023. Attackers often exploit the Ethereum (ETH) network, which was the victim of 33 incidents. On the BNB Chain (BNB) blockchain, he is the second most attacked, being exploited 14 times. Ethereum and BNB chains accounted for over 73% of the lost funds.

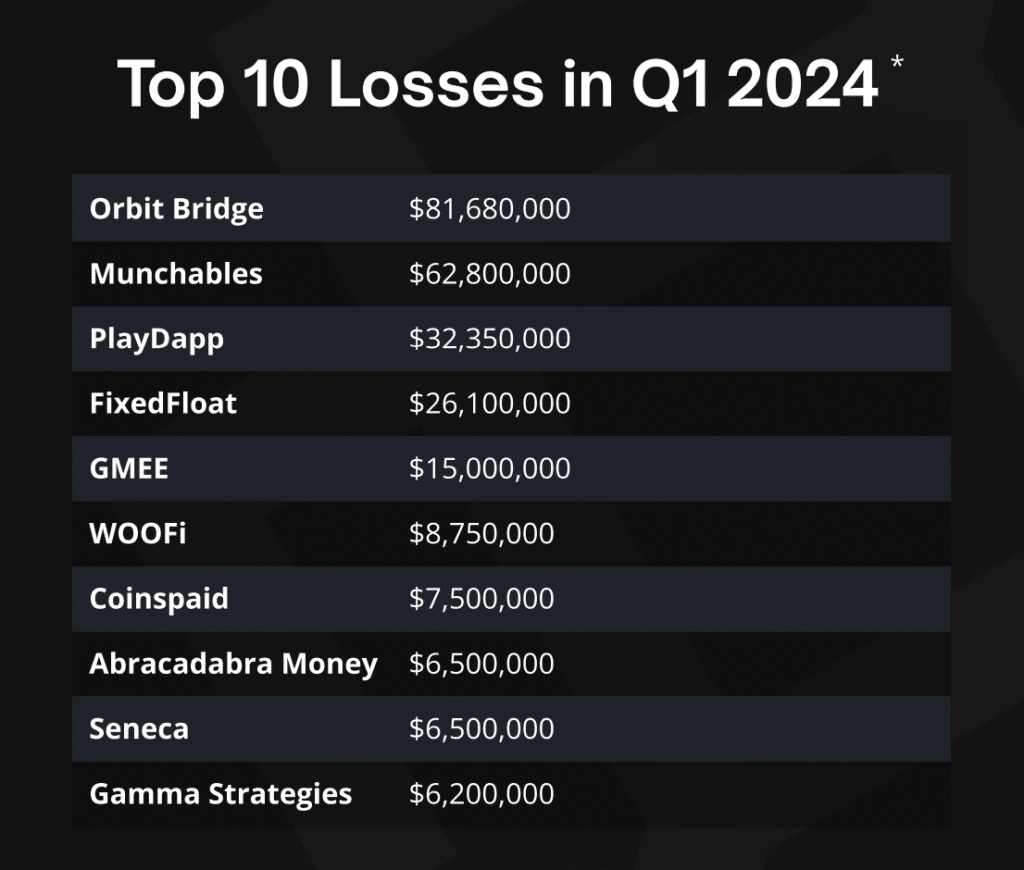

The biggest hacks were against the Orbit Bridge and Munchables web3 gaming platforms. The attackers stole more than $81 million from Orbit and nearly $63 million from Munchables. The pair was followed by PlayDapp and FixedFloat, which lost $32 million and $26 million, respectively.

Hacking remains the most common method of cryptocurrency theft in the industry, accounting for 95.6% of total losses, while only 4.4% is due to fraud. According to analysts, in the past 12 months fraud cases fell by 22.4%.

In 2023, hackers withdrew $19 million from crypto projects, compared to $14 million this year. However, only 22% of the stolen funds, or $73 million, were returned this year.

Remarkably, the Concentrated Finance (CEFI) sector did not make any losses in the first three months of 2024, while it suffered a loss of $1.8 million in the same period last year.