Image credits: Bryce Durbin/TechCrunch

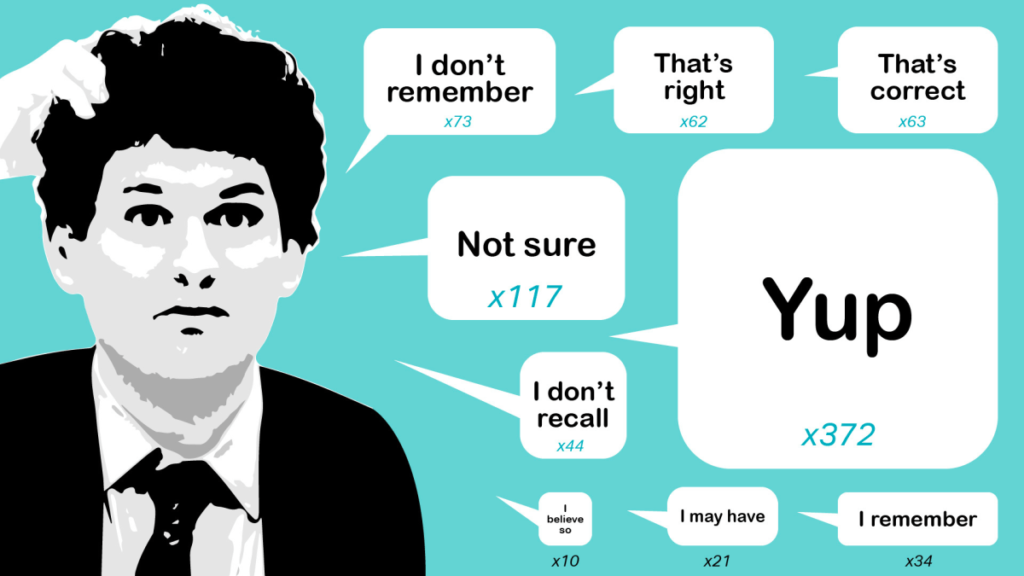

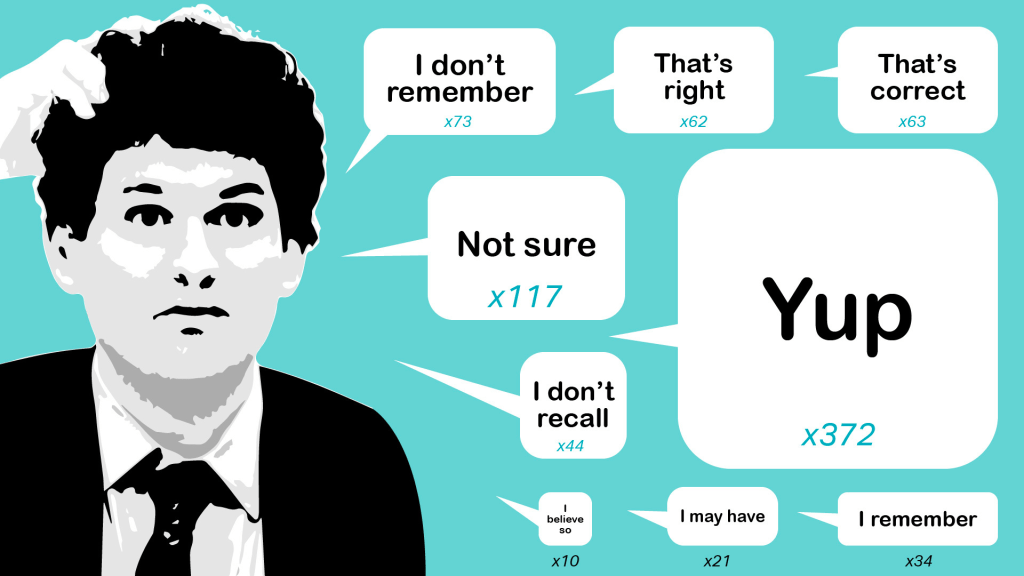

On Thursday, a federal judge sentenced former FTX CEO Sam Bankman Fried to 25 years in prison after being convicted of seven counts of wire fraud and money laundering.

The scam he pulled was very simple. He and his partners founded FTX, an exchange that accepts deposits from customers and invests and trades in cryptocurrencies. Some of these deposits were secretly sent to another company of his, Alameda Research, a hedge fund that he originally founded to arbitrage differences in cryptocurrency prices across countries. It was something I did. According to the government's successful lawsuit, Alameda used the money for a variety of purposes it wasn't supposed to be used for, including investing in other crypto startups, buying really nice real estate, supporting political campaigns, and most importantly… What was important was the purpose of the fraud. — Powers FTX's proprietary cryptographic token, FTT.

A few document leaks, some smart work by CoinDesk journalists, and a well-timed tweet from Changpeng “CZ” Chao, who runs rival cryptocurrency exchange Binance, combined to It caused a bank run. The scheme unraveled in a matter of days, leaving billions of dollars of customer money gone (though, apparently, a significant portion of that money could be returned). CZ himself has pleaded guilty to money laundering violations related to poor management and is no longer running Binance.

The ruling brings to an end the latest era in cryptocurrencies, which was marked by the emergence of get-rich-quick schemes by the big fools, including digitally watermarked images. Investors were seduced by promises of incredibly high returns on everything from money to simple interest. Token payments this week, and fraud investigations and prosecutions on the way.

Crypto optimists like Andreessen Horowitz's Chris Dixon believe we are now entering a cooler phase of cryptocurrencies, where software developers will eventually create the original blockchain (Bit It suggests that useful applications will be built on one of the many blockchains that have emerged since the inception of the blockchain (the one on which the coin is based). It was first proposed by the pseudonym Satoshi Nakamoto and distributed on Halloween 2008.

The problem with this perspective is that developers have built a variety of applications on top of Ethereum, Solana, and other layer 1 blockchains over the years, and the only economically viable The purpose is speculation. Yes, it is possible to create a digitally authenticated work of art, but the value of that art is not in the aesthetic pleasure it brings, but rather in the possibility that someone else will later buy it for more money. there is.

Almost everything else built on or enabled by blockchain replaces something that already works pretty well. Self-executing smart contracts are an alternative to regular contracts. They're not perfect, but they're not so ridiculously inefficient as to bring the economy to a halt. Decentralized autonomous organizations (DAOs), where decision-making is shared equally among all participants, are similar to other decentralized organizations such as holacracy and San Francisco Board of Supervisors meetings, which are characterized by hours of discussion and few concrete decisions. It replaces the type organization scheme. All kidding aside, where are the clear killer apps for blockchain? Where are the breakthrough success stories?

Forget about runaway success. He has yet to find a single blockchain-based startup with enough cash flow or profitability to go public. Yes, there are Bitcoin mining companies like Riot. Yes, there are companies like Coinbase and Block (formerly Square) that facilitate cryptocurrency trading. But no company has actually developed economic value by doing something completely new or better on blockchain.

I welcome persuasion. Blockchain geniuses, please pitch me a startup that creates incredible value! — But my current view is that cryptocurrencies are a nation-based currency for storing and exchanging value. The idea is that it will return to Bitcoin's original function as an alternative. That volatility may be incomprehensible to people living in relatively stable economies, but in countries with runaway inflation, corrupt governance, civil unrest and war, collapsing local currencies can be converted into Bitcoin, stablecoins, etc. , and converting to a stable domestic currency like the U.S. dollar remains a reasonable and in-demand way for those who have some means to preserve those means. It's also convenient for sending money without paying exorbitant fees to international money exchangers. It can also, in some cases, serve as a digital replacement for a suitcase full of cash for all kinds of underground economic activities.

Why Bitcoin and not a new coin? Because those other coins are almost universally based on faith, trust, and fairy dust. The primary value they have is the value assigned to them by the people who hold and trade them. You could argue like a second-year college student that money is just like that, but the reality is that the U.S. dollar is backed by the enormous economic and military power of the United States. You're actually managing real resources that people actually want and need.

Bitcoin is similarly backed by something real and tangible: energy. Because of its proof-of-work model, the only way to create and verify new Bitcoins is to consume energy, whether by burning natural gas or connecting to a nearby nuclear power plant. . Energy powers the real world economy, and unless Sam Altman or someone unlocks nuclear fusion to provide truly “unmeterable” energy, energy will remain a real asset with real value for some time to come. will continue to be. If demand for Bitcoin stabilizes, the price should theoretically follow the price of electricity. In fact, I wouldn't be surprised at all if Satoshi had some ties to the energy industry.