A federal judge in Manhattan said Wednesday that the U.S. securities regulator's case against Coinbase could move forward, but dismissed one of the claims the agency had brought against the largest U.S. cryptocurrency exchange. .

U.S. District Judge Katherine Polk Feira partially granted Coinbase's motion to dismiss a Securities and Exchange Commission lawsuit alleging that Coinbase ignores regulations.

While the ruling was a partial victory for Coinbase in a potentially long and expensive legal battle, other judges largely celebrated the SEC's approach to cryptocurrencies and sided with the regulator. I also agreed with their opinion.

Following the ruling, Coinbase's stock price fell 2%.

Paul Grewal, Coinbase's chief legal officer, said in a social media post about X that the exchange is prepared for the judgment and will continue to fight the SEC's claims.

“We remain confident in our legal arguments and look forward to proving us right,” he said.

An SEC spokesperson did not respond to a request for comment.

In June, the SEC accused Coinbase of facilitating trading in at least 13 crypto tokens that should be registered as securities and illegally operating as a national securities exchange, broker, or clearing house without registering with regulators. , sued Coinbase.

Failla allowed most of the lawsuit to proceed, but rejected the SEC's claims that Coinbase acted as an unregistered broker through its wallet application.

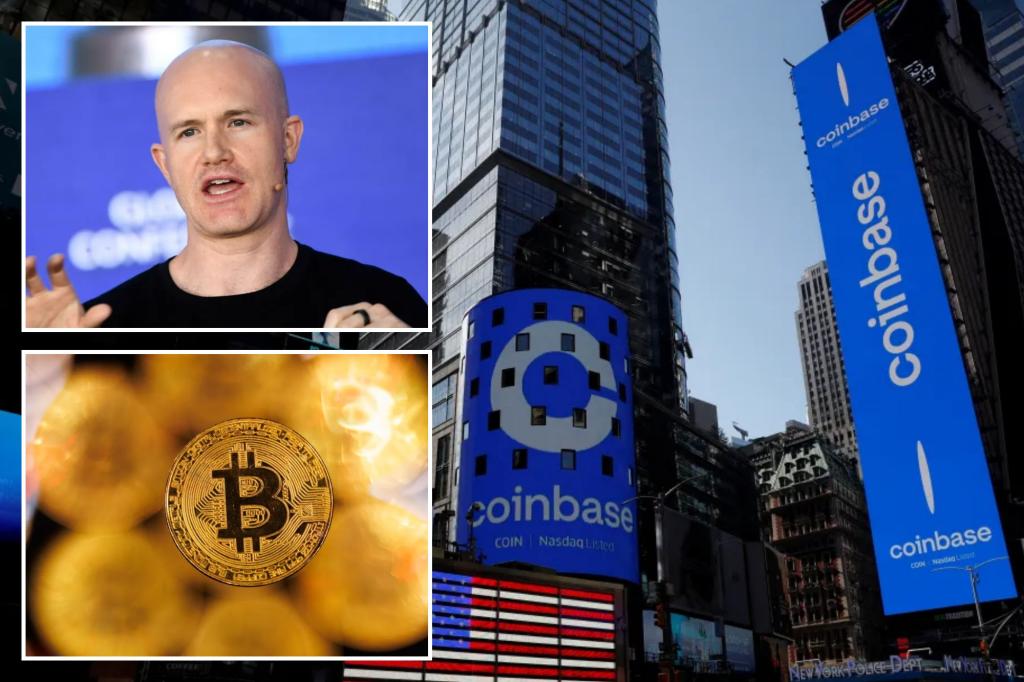

The lawsuit against the world's largest publicly traded cryptocurrency exchange is a high water mark in the regulator's campaign to apply U.S. securities laws to digital asset companies.

To do so, the SEC has relied primarily on Supreme Court decisions establishing the test for whether an investment qualifies as a security. The important question is whether the revenue is “derived solely from the efforts of others.”

Coinbase argued that crypto assets, unlike stocks and bonds, do not meet that definition, a position held by the majority of the crypto industry.

Failla rejected this argument, saying the SEC's argument that at least some digital assets listed on exchanges are securities is plausible.

The SEC pointed to statements by developers such as Solana Labs and Polygon Technology about their efforts to build and improve the technology.

“Objective investors in both the primary and secondary markets would perceive these statements as promises of the potential for profits derived solely from the efforts of others,” Failla wrote. .

In several cases that have gone to court, judges have largely agreed with the SEC that the crypto assets at issue are securities.

Unlike assets such as highly regulated products, securities must be registered with the SEC by the issuer.

It also requires detailed disclosures to inform investors of potential risks.