Perdoceo Education Corporation (NASDAQ:PRDO) President and CEO Todd Nelson sold 48,000 shares of the company's stock on March 26, 2024, according to a recent SEC filing. did. The transaction was executed at an average price of $17.76 per share for his total sale price of $852,480.

Perdoceo Education Corp is an educational services company offering a wide range of academic programs through online platforms and campuses. The company operates a variety of universities and institutions, offering associate's, bachelor's, master's and doctoral degree programs, as well as non-degree programs in career-oriented fields.

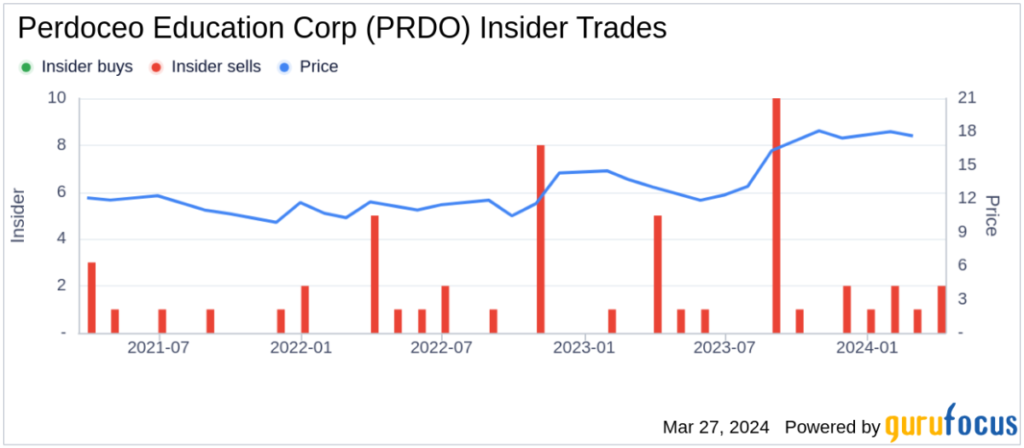

Over the past year, insiders have sold a total of 449,283 shares of Perdoceo Education Corporation stock, but did not buy any shares. The recent insider selling is part of a trend observed over the past year, where there were 21 insider sales and zero insider purchases.

On the day of the most recent insider sale, Perdoceo Education Corporation stock was trading at $17.76, giving the company a market cap of $1.161 billion. The company's price-to-earnings ratio of 8.12 is lower than the industry median of 19.89, but higher than the company's historical median price-to-earnings ratio.

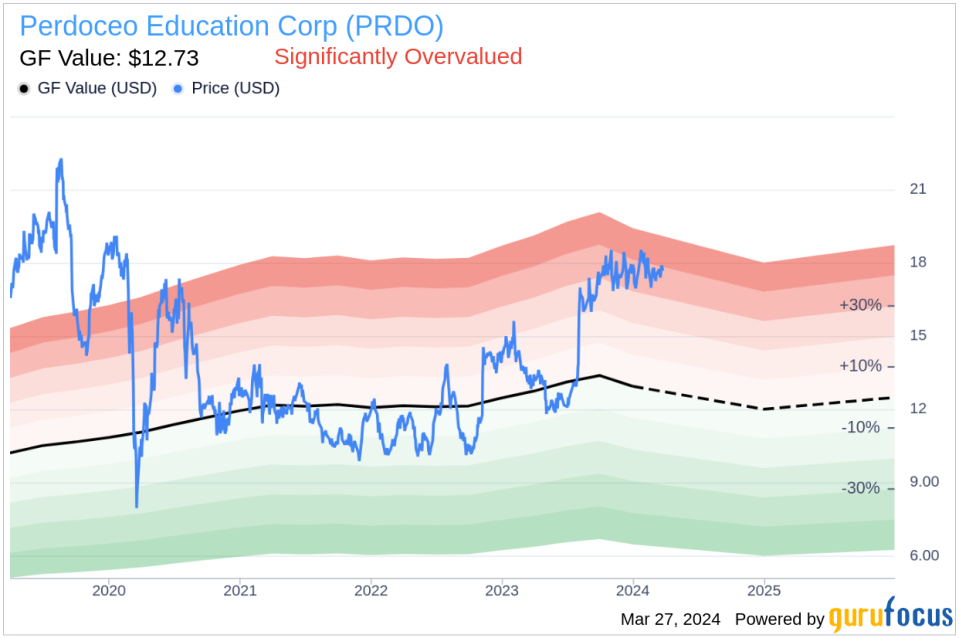

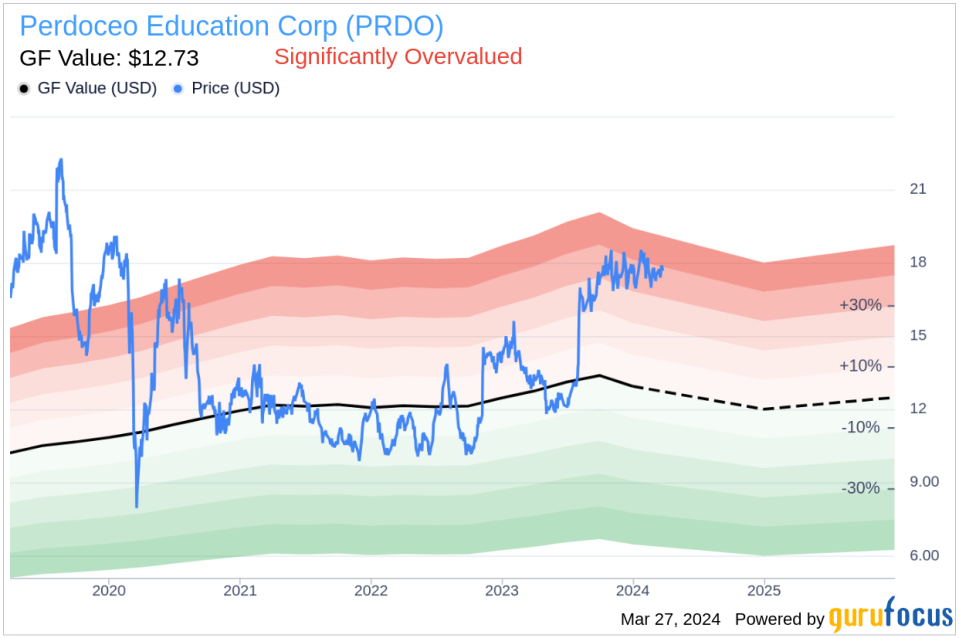

According to GuruFocus Value chart, with current price of $17.76 and GF Value of $12.73, Perdoceo Education Corp's Price to GF Value ratio is 1.4, indicating that the stock is significantly overvalued based on GF Value. is shown.

GF Value is calculated by considering historical trading multiples, GuruFocus adjustment factors based on past earnings and growth, and future earnings estimates provided by Morningstar analysts.

Investors and analysts often monitor insider sales as they can get an insider's perspective on the value of a company's shares. However, insider trading is not always indicative of future stock performance and can be influenced by a variety of factors, including personal financial requirements and portfolio diversification strategies.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.