David Eben put it well: “Volatility is not a risk we care about.” Our focus is to avoid permanent loss of capital. ” So when you think about the risk of a particular stock, it may be obvious that you need to consider debt. Because too much debt can sink a company.Like many other companies New Oriental Educational Technology Group Co., Ltd. (NYSE:EDU) uses debt. But is this debt a concern for shareholders?

What risks does debt pose?

Debt is a tool to help businesses grow, but if a business is unable to repay its lenders, it is at their mercy. If the situation gets too bad, lenders may take control of your business. But a more common (but still expensive) situation is when a company needs to dilute shareholders at a cheap share price just to manage its debt. The advantage of debt, of course, is that it is often cheap capital, especially when it replaces dilution in a company that can be reinvested at a high rate of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for New Oriental Education & Technology Group.

What is New Oriental Education & Technology Group's net debt?

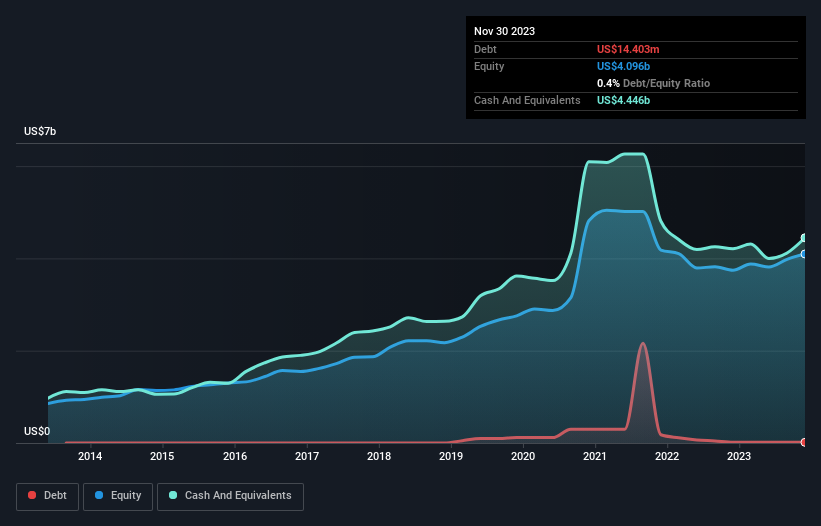

The graphic below, which you can click on for historical numbers, shows that New Oriental Education & Technology Group had debt of US$14.4m in November 2023, down from US$15.1m one year ago. . However, it also held US$4.45b in cash offsetting this, meaning it had net cash of US$4.43b.

How healthy is New Oriental Education & Technology Group's balance sheet?

The most recent balance sheet shows that New Oriental Education & Technology Group had liabilities of US$2.66b falling due within a year, and liabilities of US$370.8m falling due beyond that. Masu. Offsetting this, it had cash of US$4.45b and his receivables of US$40.8m due within 12 months.So there's actually US$1.45 billion more There are more current assets than total liabilities.

This surplus suggests that New Oriental Education and Technology Group has a conservative balance sheet and could probably eliminate its debt without too much difficulty. Simply put, the fact that New Oriental Education & Technology Group has more cash than debt suggests that it can manage its debt safely.

It's also positive to see that New Oriental Education & Technology Group grew its EBIT by 29% in the last year, which should make it easier to pay down its debt going forward. There's no question that we learn most about debt from the balance sheet. However, more than anything else, it will be future earnings that will determine whether New Oriental Education & Technology Group can maintain a strong balance sheet going forward. So if you want to see what the experts think, you might find this free report on analyst profit forecasts to be interesting.

Finally, companies can only pay off debt with cold hard cash, not accounting profits. New Oriental Education & Technology Group may have net cash on its balance sheet, but it's still interesting to note how well this business converts its earnings before interest and tax (EBIT) into free cash flow is. , and the ability to manage debt. Fortunately for shareholders, New Oriental Education & Technology Group actually generated more free cash flow than its EBIT over the last two years. This kind of powerful redemption excites us as much as the audience at a Daft Punk concert when the beat drops.

summary

It's always wise to research a company's debt, and in this case New Oriental Education & Technology Group has a decent balance sheet with net cash of US$4.43b. And we're impressed by his free cash flow of US$1.1b, representing 184% of his EBIT. So is New Oriental Education & Technology Group's debt a risk? We don't think so. Over time, stock prices tend to track his earnings per share, so if you're interested in New Oriental Education & Technology Group, click here to view his earnings per share history interactive You may want to check the graph.

At the end of the day, it's often better to focus on companies with no net debt. You can access a special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we help make it simple.

Please check it out New Toyo Educational Technology Group Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.