Asset management giant BlackRock (BLK) on Wednesday officially announced a tokenized asset fund on the Ethereum network.

According to reports, the BlackRock USD Institutional Digital Liquidity Fund will be represented by the blockchain-based BUIDL token, fully backed by cash, US Treasury securities, and repurchase contracts, and will receive tokens daily via blockchain rails. It is said to provide a yield that is paid to holders. release.

According to BlackRock, Securitize will act as the transfer agent and tokenization platform, while BNY Mellon will be the custodian of the fund's assets. Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks also participate in the fund's ecosystem.

BlackRock also made a “strategic investment” in Security Tides, the press release added, but terms of the deal were not disclosed.

“This is the latest development in our digital asset strategy,” said Robert Mitchnick, head of digital assets at BlackRock. “We are focused on developing solutions in the digital assets space that help our clients solve real-world problems, and we are excited to be working with Securitize.”

The announcement comes after regulatory filings revealed that BlackRock has incorporated the fund with Securitytize, a tokenized fund, as observers pointed to blockchain transactions seeding the vehicle. The speculation has been fueled, CoinDesk reported on Tuesday.

BlackRock is the latest traditional financial giant to enter the tokenization space, with Citi, Franklin Templeton and JP Morgan already working on developing tokenization technology. The creation of blockchain-based tokens of traditional investments such as bonds and funds (known as real-world asset tokenization (RWA)) is becoming increasingly popular as digital assets and traditional finance (TradFi) become more closely intertwined. It is rapidly growing as a use case for chains. Tokenized US TreasuriesFor example, I grew up with: $730 million It will rise from $100 million in early 2023 as crypto companies look to earn stable yields by storing on-chain funds.

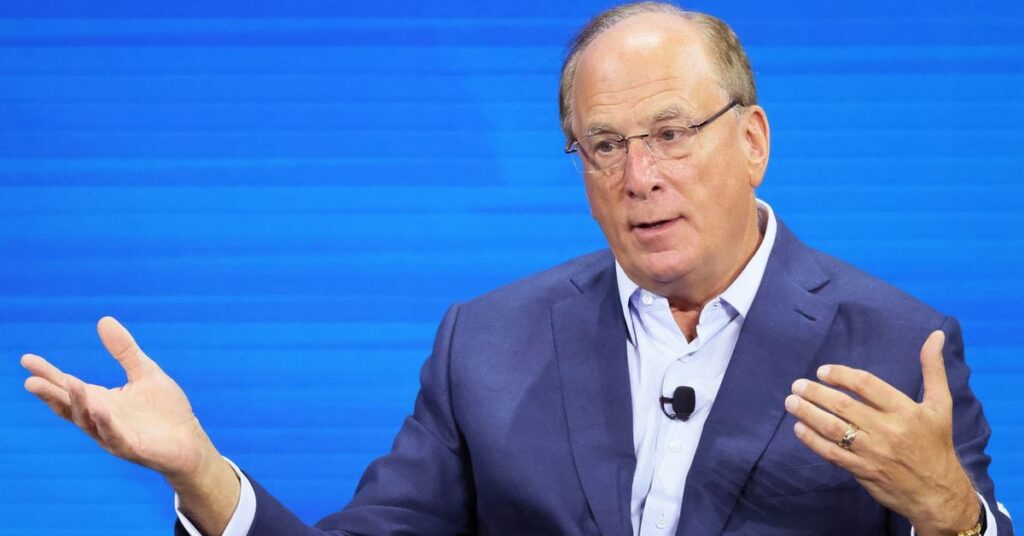

BlackRock CEO Larry Fink said in an interview with CNBC earlier this year that the company's Spot BTC ETF is a “stepping stone toward tokenization.”