Over the past day, the cryptocurrency market has experienced significant turmoil as the price of Bitcoin fell below $65,000, leading to widespread liquidations.

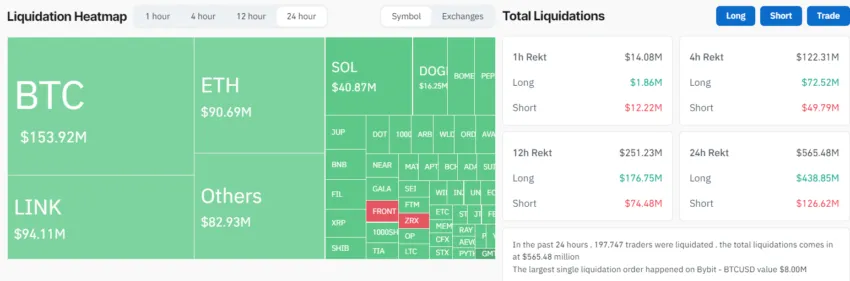

This sharp decline wiped out nearly $565 million in market value, impacting long and short traders.

Long traders suffer losses of over $400 million

The crypto market downturn caught bullish traders by surprise, with losses for the group exceeding $400 million in just the previous day.

According to data from CoinGlass, price speculators lost a total of $565 million during this period. Long traders bore the brunt of losses of $438 million, while short traders faced liquidations of $126 million.

In particular, long Bitcoin traders were hit the hardest, with losses of $153 million, followed by Chainlink enthusiasts with losses of $94 million. Ethereum and Solana traders also lost more than $130 million combined.

These events affected over 200,000 traders, with over 50% trading on Binance and OKX exchanges.

Read more: 10 Best Cryptocurrency Exchanges and Apps for Beginners in 2024

This slump is likely due to the fact that the price of Bitcoin at one point fell below $65,000, the lowest since early March. As a major digital asset, BTC price movements typically determine the trajectory of the broader market. As a result, major cryptocurrencies such as Ethereum, Avalanche, BNB, Cardano, and Chainlink experienced significant price declines.

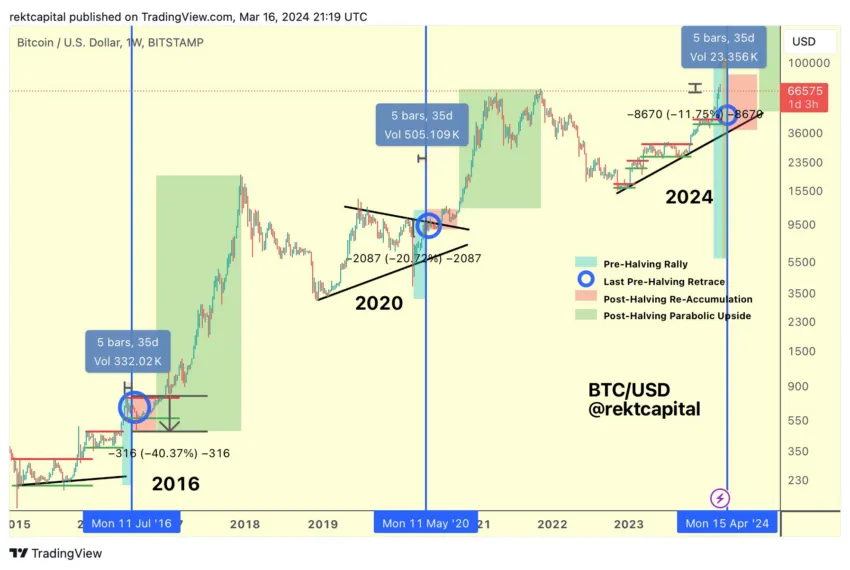

On the other hand, several crypto analysts interpret this decline as a predictable market movement. Despite the introduction of spot Bitcoin exchange-traded funds (ETFs), the current bull market remains susceptible to pre-halving retrace, according to Recto Capital. These retraces typically occur 14 to 28 days before Bitcoin's halving.

Read more: Bitcoin Price Prediction 2024/2025/2030

Compared to previous cycles, analysts believe that BTC's current 11% pullback within 31 days of the halving is similar to historical patterns in 2020 and 2016, when retraces were 20% and 40% deeper, respectively. It is pointed out that

“Bitcoin will reverse deep enough to convince us that the bull market is over, and then return to an uptrend,” Recto Capital concluded.

As such, analysts have warned that BTC will enter the “danger zone” within the next three days, urging traders to be cautious.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.