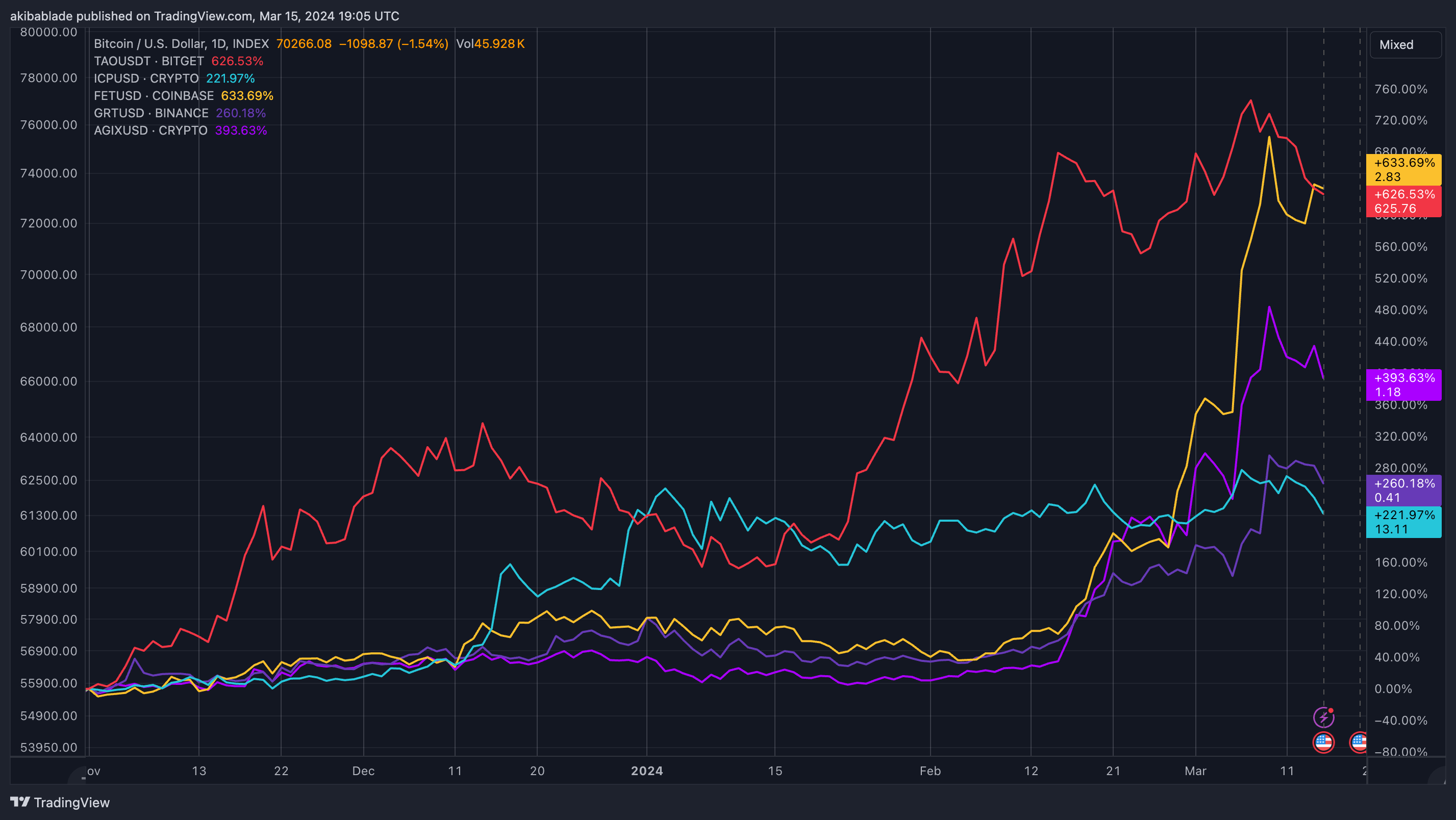

After a face-melting rally in the AI crypto sector over the past few months, investors seem to have taken a profit-taking approach in recent days. The sector soared past $10 billion in mid-February, driven by an impressive rise in Bittensor's market capitalization, which will increase by more than 220% in 2024 to reach a market cap of $4 billion. By March, the sector's market capitalization had exploded to more than $25 billion.

Around March 9th, several projects such as Bittensor, Fetch, OriginTrail, Worldcoin, and Arkham hit new all-time highs, with market caps reaching nearly $30 billion.

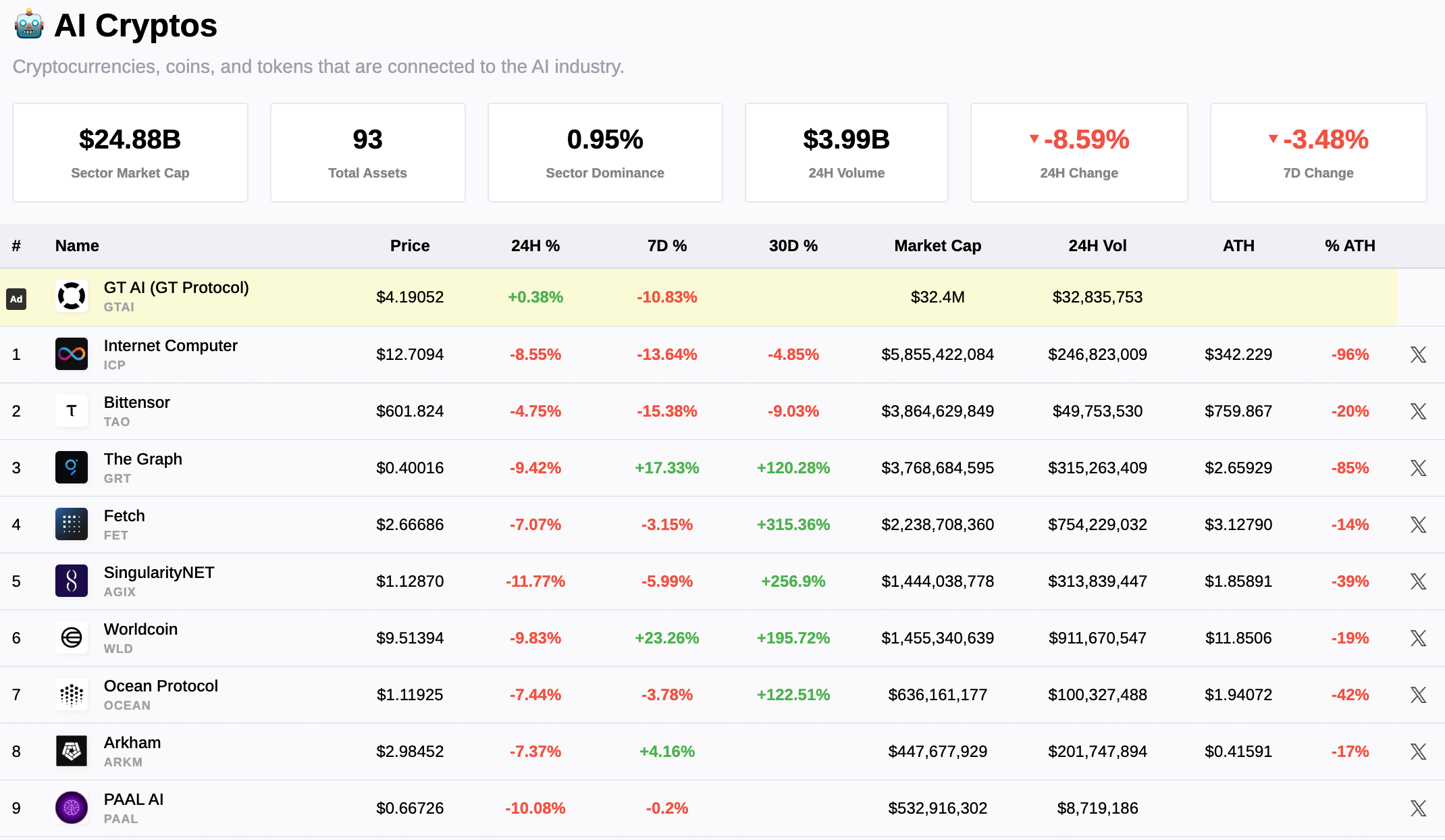

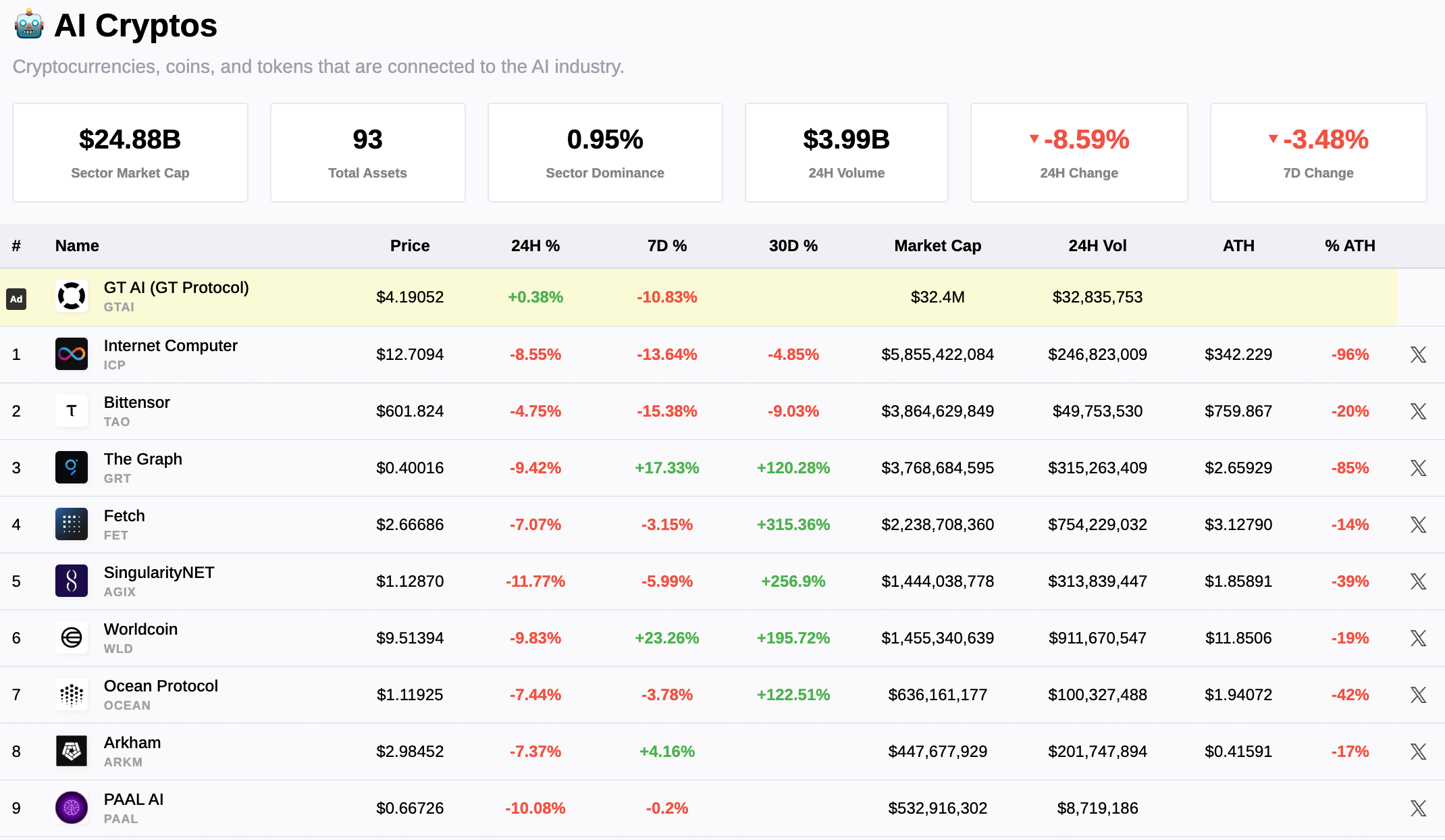

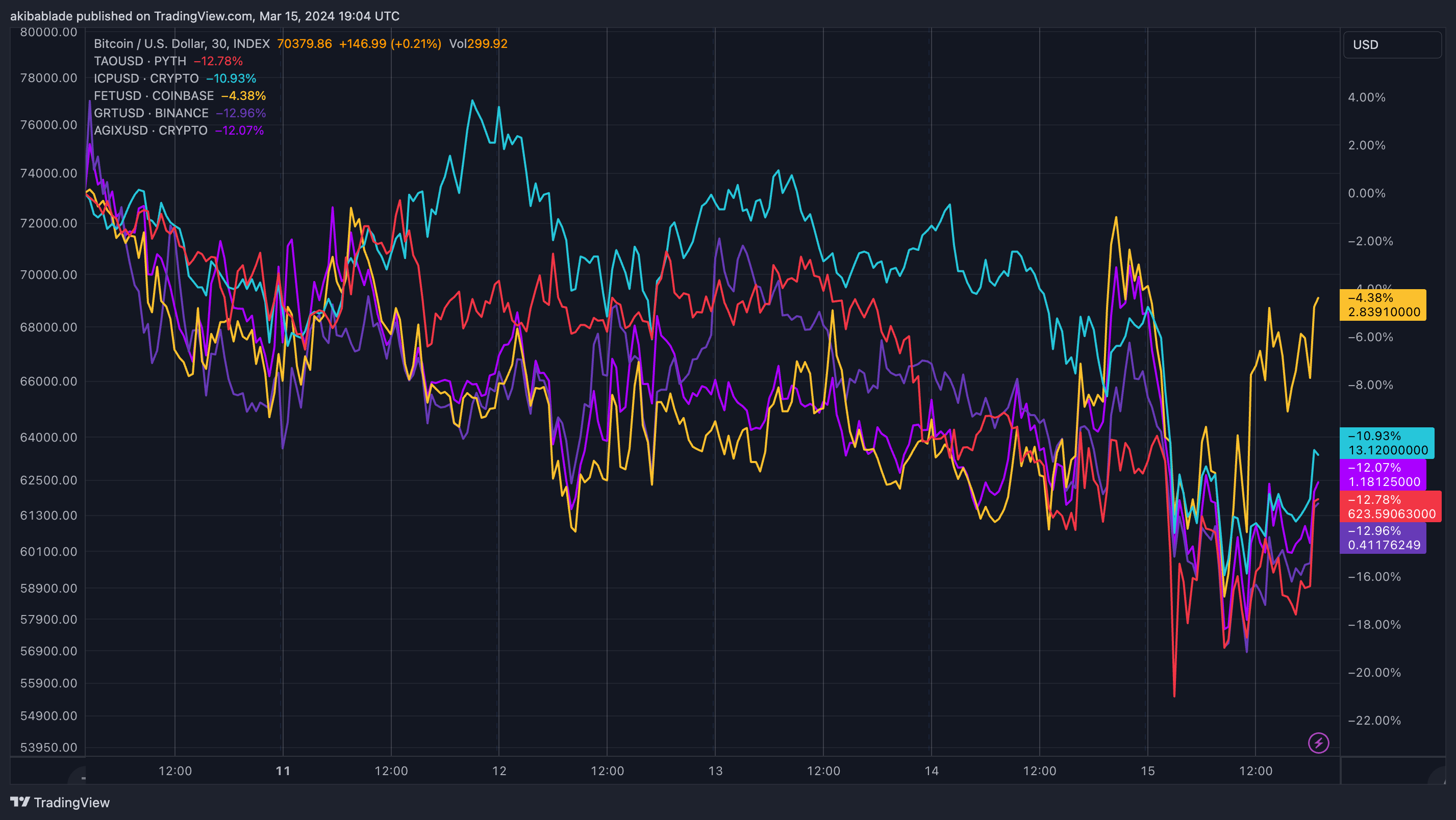

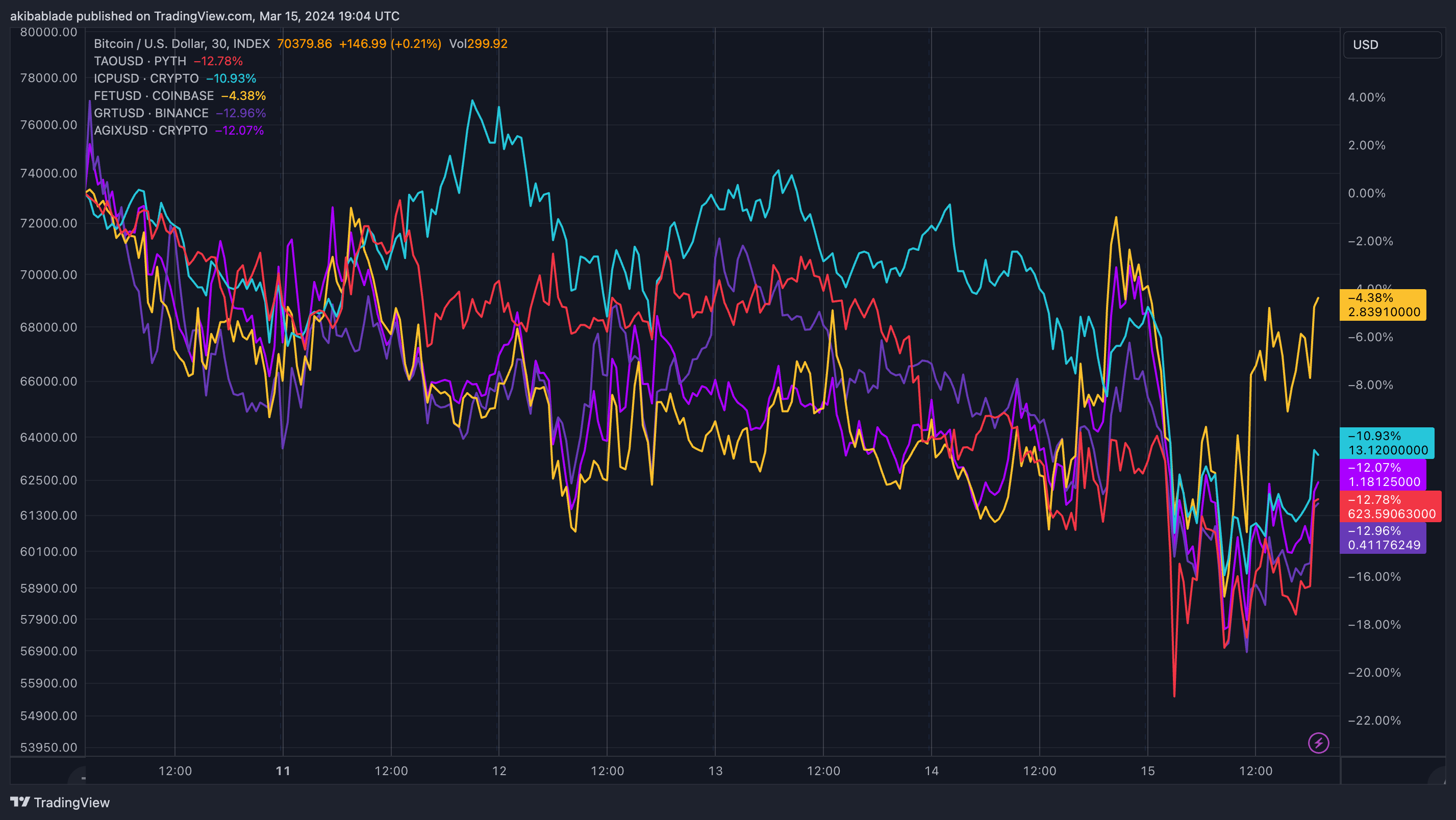

The sector's market capitalization has cooled to below $25 billion in the past few days as investors appear to be locking in profits after a potentially overheated market rally. Bitcoin has also fallen, but at the time of writing it remains just 6% below its all-time high, with most of the top 10 AI crypto projects down more than 20%.

Interestingly, many AI crypto coins do not correlate as closely with Bitcoin as other coins on the market these days. In particular, Bittensor and Fetch seem to be on their own path, only going down when Bitcoin moves significantly. Still, the coins were often slow to react or fluctuated relative to Bitcoin.

Fetch increased 140% in the four days starting March 6, but has since rebounded slightly by about 20%. Overall, since the sector's peak on March 9, Fetch is down 4%, ICP is down 11%, The Graph is down 12%, Singularity is down 13%, and Bittensor is down 12.8%.

The rise of AI in 2023 has led to a massive influx of new AI-related meme coins and hype projects, but those currently at the top of the sector charts are primarily focused on the actual implementation of decentralized AI tools. Focused. This research has attracted the attention of Ethereum's Vitalik Buterin, Eric Voorhees, and other prominent players in the cryptocurrency space.

As advances in AI development accelerate, the importance of decentralized AI models may coincide with the importance of decentralized finance. Blockchain and tokenization appear to be solid bedfellows for decentralized AI networks, and the recent retracement is more a sign of investors looking for profits than a loss of faith in the fast-growing sector. This indicates that there may be. But with such rapid returns, investors are also likely to be eager for advancements in technology offerings.

Many of the top advancements have live mainnets where projects are actively being built. The next important step is to see if network effects can connect users to the chain and participate in this fascinating cross-section of AI and blockchain. Bittensor, for example, has seen the cost of registering one of its 32 subnets rise from about $200,000 to more than $5 million this month alone, with prices determined by the market rather than a centralized organization. There is no doubt that there will be a demand for adoption as it is set by the force.