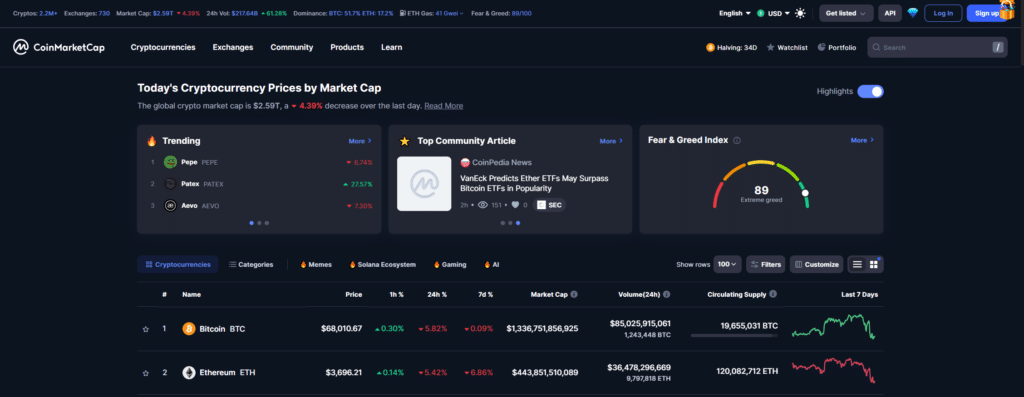

The decline in the market capitalization of Bitcoin, Ethereum, and cryptocurrencies has sparked short-term skepticism among traders, according to one options agency.

QCP Capital released an update on March 15 pointing to concerns about volatility in the cryptocurrency market after its main token, Bitcoin (BTC), fell below $66,000 for the first time in almost two weeks. .

BTC has fallen over 5% in the past 24 hours, dropping to $65,565 during trading hours. Ethereum (ETH) also returned more than 5%, rising to around $3,566, but has recovered slightly at the time of writing. According to CoinMarketCap, the overall cryptocurrency market fell by 4% on the day to $2.6 trillion.

Analysts at QCP Capital said the market is “particularly nervous” due to valuation corrections across cryptocurrencies’ two largest tokens. The company said this negative risk reversal continued into May, as indicated by large capital investors.

We also saw a significant unwinding of calls by institutional investors who had been actively buying calls along the way.

QCP Capital

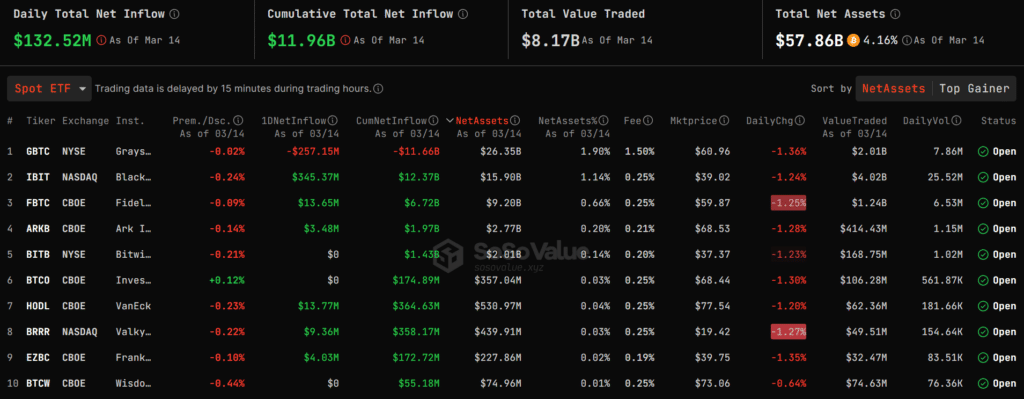

Spot Bitcoin ETF records $132 million in net inflows

Ahead of the Bitcoin market correction, March 14th saw a rare dip in interest in spot BTC ETFs. According to SoSo Value data, there was a total of $132.5 million in net inflows across the 10 tradeable funds, with BlackRock once again leading the way with $345 million.

However, $257 million in net outflows from Grayscale's GBTC slowed inflows to BlackRock's iShares Bitcoin ETF (IBIT). Funds issued by Bitwise, Invesco Galaxy and WisdomTree had net inflows of $0.