BlackRock, the world's largest asset manager, has confirmed that its Bitcoin ETF (exchange traded fund) has reached $10 billion in assets under management (AUM) faster than any ETF in U.S. history.

This milestone is driven by the continued rise in the price of Bitcoin (BTC), the world's leading cryptocurrency.

BlackRock’s BTC ETF Reaches New Milestone

This milestone, triggered by the soaring price of Bitcoin, highlights the growing interest and adoption of digital assets in the traditional investment world.

Founded in January, IBIT has quickly gained traction among investors seeking exposure to Bitcoin. IBIT's launch coincided with a bullish phase for Bitcoin, with Bitcoin reaching new highs and attracting significant attention from both institutional and retail investors.

The U.S. Securities and Exchange Commission's (SEC) approval of a Spot Bitcoin ETF earlier this year was a pivotal moment for the crypto market. This regulatory approval paves the way for a surge in assets under management for various Bitcoin ETFs, with BlackRock’s IBIT leading the way.

The fund's success can be attributed to favorable market conditions, investor confidence, and mainstream acceptance of cryptocurrencies as legitimate investment opportunities.

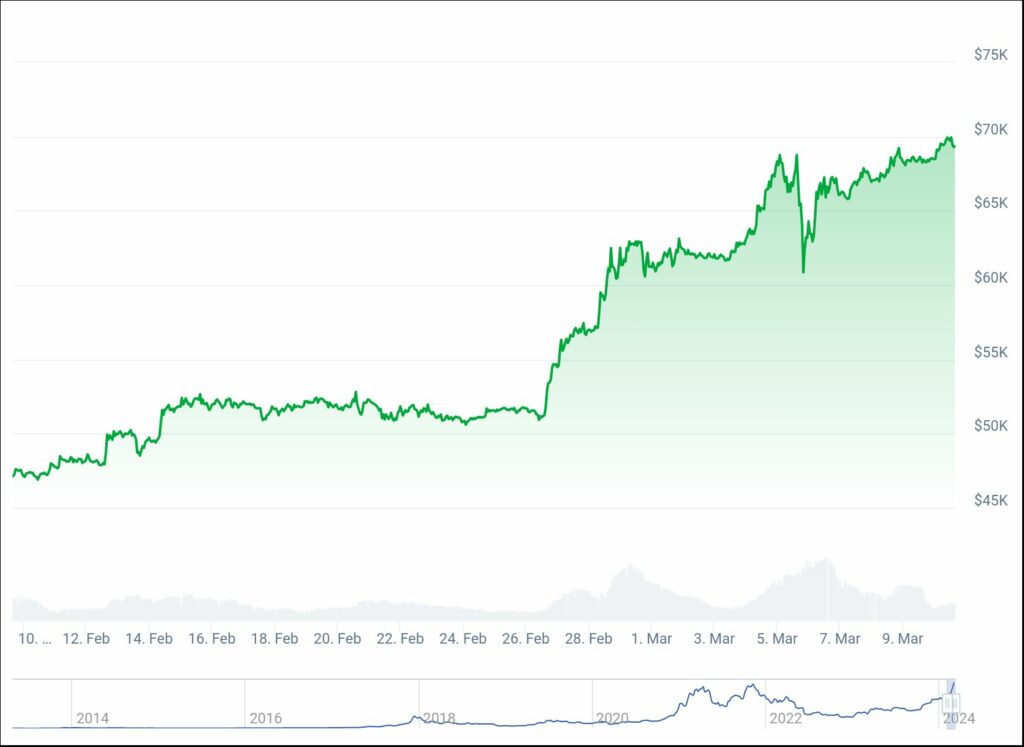

According to data from CoinGecko, Bitcoin (BTC) is up an impressive 11% over the past seven days and a whopping 47% in the past month. On March 1st, Bitcoin (BTC) price exceeded $60,000, marking the first time it reached this level since November 2021.

BlackRock's performance with IBIT is not an isolated event, but rather part of a broader trend in the market. Other funds, such as Fidelity's Wise Origin Bitcoin Fund, have also seen significant increases in assets under management, reflecting the broader shift to digital assets in the investment landscape.

The inflows into these ETFs highlight the growing appeal of cryptocurrencies as an alternative asset class and highlight the role of ETFs in providing investors with easy access to this emerging market. . As of this writing, Bitcoin (BTC) is trading at $69,223.

Bitcoin ETF attracts huge amount of money

Bitcoin exchange-traded funds (ETFs) have emerged as an important investment option, with iShares, Fidelity, and Ark Investment Management leading the way in attracting new capital since their launch.

March 5th, BlackRock's iShares Bitcoin ETF (IBIT) experienced Net inflows reached $788 million, setting a new daily record for this investment vehicle.

The IBIT ETF has had more than $9 billion in cumulative inflows and currently has nearly $12 billion in assets under management, according to SoSoValue. The basis of this asset pool is over 183,000 Bitcoin (BTC) acquired by the asset manager since January 11, the official trading start date.

BlackRock's largest single-day inflow was also the company's most significant BTC acquisition, gaining around 12,600 Bitcoin in a single day. This exceeds the previous record purchase amount on February 28, when the Bitcoin ETF issuer raised over 10,140 BTC for the IBIT fund.

As reported by crypto.news, BlackRock intends to expand its investment in BTC ETFs through its Strategic Income Opportunities Fund. The Wall Street giant revealed its plans in a filing with the U.S. Securities and Exchange Commission on March 4, shortly after announcing the introduction of a Bitcoin ETF in Brazil.

Furthermore, Fidelity's Wise Origin Bitcoin Fund has also recorded significant net inflows since its inception, indicating growing demand for spot Bitcoin ETFs. Cathie Wood's Ark21Shares Bitcoin ETF also gained momentum, amassing more than $600 million in assets by the end of January.

These success stories highlight the growing demand for crypto investing and the market's positive reception of these innovative ETF products.

In contrast to the success stories, Wisdom Tree, Valkyrie, and Franklin Templeton have struggled to match the inflow levels of their competitors due to various factors such as market positioning, investor perception, and competitive dynamics in the crypto investment environment. I'm having a hard time.

The differing fortunes of these Bitcoin ETFs highlight the competitive nature of the crypto investment space and the importance of factors such as brand reputation, fund structure, and market timing in attracting investor interest. I'm doing it.