Some investors rely on dividends to grow their wealth. If you're one of those dividend experts, you might want to know the following: IDP Education Limited (ASX:IEL) is about to go ex-dividend in just four days. The ex-dividend date is one business day before the record date and is the closing date on which a shareholder is on the company's books and eligible for dividend payments. The ex-dividend date is important because trades in the stock must be settled before the record date in order to receive the dividend. Therefore, IDP Education investors who purchased shares after March 7th will not receive the dividend, which will be paid to him on March 27th.

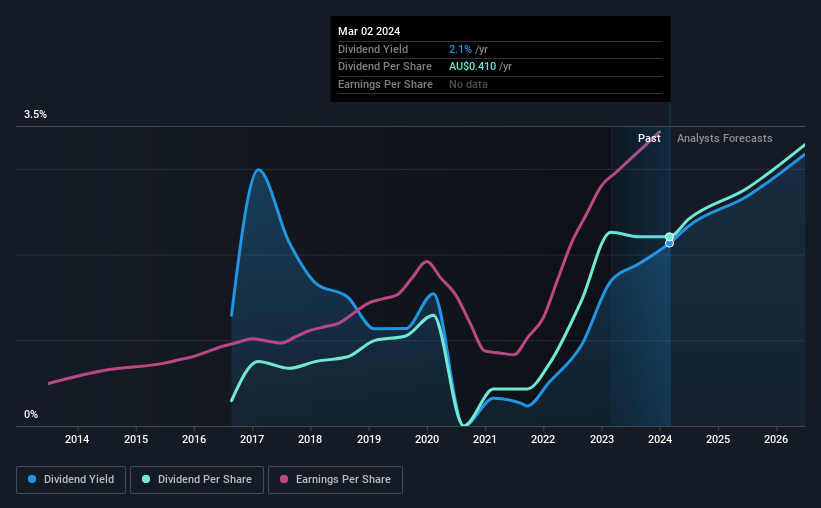

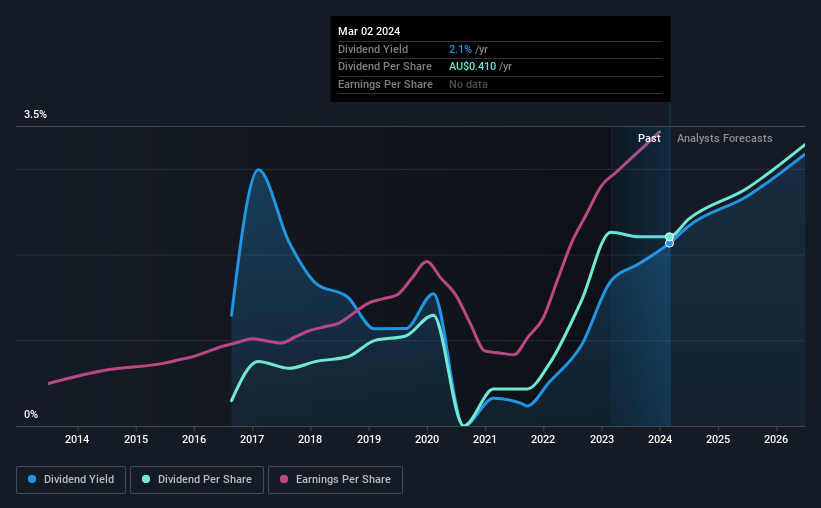

The company's upcoming dividend is AU$0.25 per share, following the company's distribution of a total of AU$0.41 per share to shareholders in the last 12 months. Based on the last year's worth of payments, IDP Education currently has a yield of 2.1% on the current share price of AU$19.22. Dividends are an important source of income for many shareholders, but the health of the business is critical to maintaining dividends. That's why we should always check whether the dividend payments are sustainable, and if the company is growing.

Check out our latest analysis on IDP Education.

If a company pays out more in dividends than it earned in profit, then the dividend might become unsustainable – hardly an ideal situation. Last year the company paid out 77% of its profits as dividends, which is not unreasonable, but limits reinvestment into the business and leaves the dividend vulnerable to economic downturns. There may be concerns if revenues start to decline. A useful secondary check is to assess whether IDP Education generated enough free cash flow to pay its dividend. The company paid out 93% of its free cash flow in the form of dividends last year, which is outside the comfort zone of most companies. Businesses typically need cash more than they need revenue. In other words, the expenses are not your responsibility. So it's not great to see them paying out so much of their cash flow.

IDP Education's dividend was covered by the company's reported profits, but cash is slightly more important, so we're not happy to see that the company didn't generate enough cash to pay its dividend. As the saying goes, cash is king, and we would consider this a red flag if IDP Education repeatedly paid dividends that weren't fully covered by cash flow.

Click here to see the company's payout ratio and analyst estimates of its future dividends.

Are profits and dividends growing?

Companies with consistently growing earnings per share usually make the best dividend stocks, as it is easier to grow dividends per share. If profits decline significantly, the company may be forced to cut its dividend. It's encouraging to see that IDP Education has rapidly grown its earnings at 23% per year over the past five years. Although earnings are growing rapidly, we're concerned that dividend payments have consumed most of the company's cash flow over the past year.

Another important way to measure a company's dividend prospects is by measuring its historical dividend growth rate. Over the past eight years, IDP Education has grown its dividend at an average annual rate of approximately 29%. It's great to see that earnings per share have grown rapidly over the years, and that he's also grown dividends per share accordingly.

conclusion

Is IDP Education an attractive dividend stock, or should it be left on the shelf? Earnings per share growth is positive and the company's payout ratio looks normal. However, we note that IDP Education is paying out a much higher percentage of its free cash flow, which makes us uncomfortable. In summary, IDP Education looks okay on this analysis, but it doesn't look like it has any outstanding opportunities.

Curious about what the future holds for IDP Education? See what the 15 analysts we track are predicting by visualizing past and future expected earnings and cash flow.

If you're in the market looking for high dividends, we recommend: Check out our selection of high-dividend stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.