A Deloitte survey of African financial institutions found that attitudes towards cryptocurrencies among banks, insurance companies and other institutions have cooled significantly. Just 30% think they have a chance, down from 63% a year ago. However, the previous investigation was just before the FTX virtual currency exchange went bankrupt. The most recent was between August and October of last year, before the recent uptick in activity.

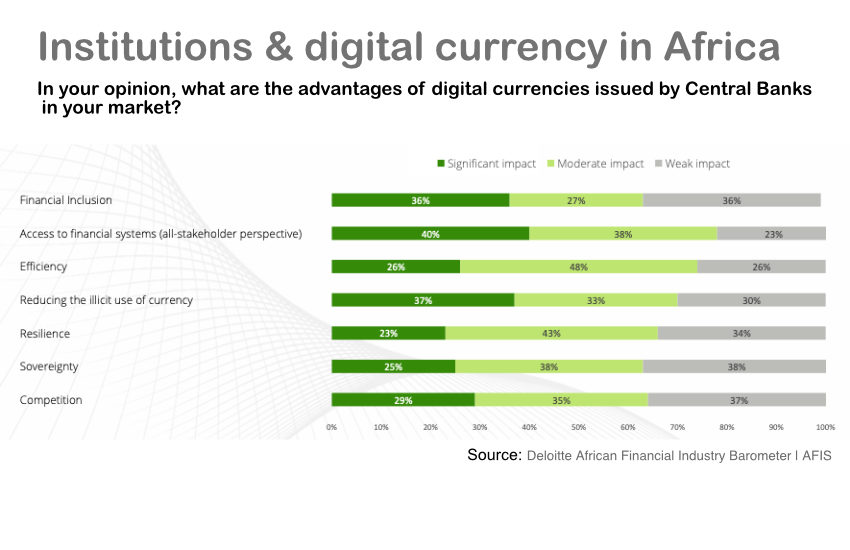

There has been a more subtle shift in the focus on central bank digital currencies (CBDCs). Slightly more people (36%) expect a significant impact on financial inclusion (previously 33%). However, the proportion decreased significantly, with more expecting the effect of financial inclusion to be moderate (down from 37% to 27%) and weak (up from 30% to 36%). . These numbers may reflect Nigeria's Enaira, which is struggling to gain traction.

We have seen significant improvements in several other benefits of CBDCs, particularly in efficiency and sovereignty.

Cryptocurrency in Africa: More emphasis on payments

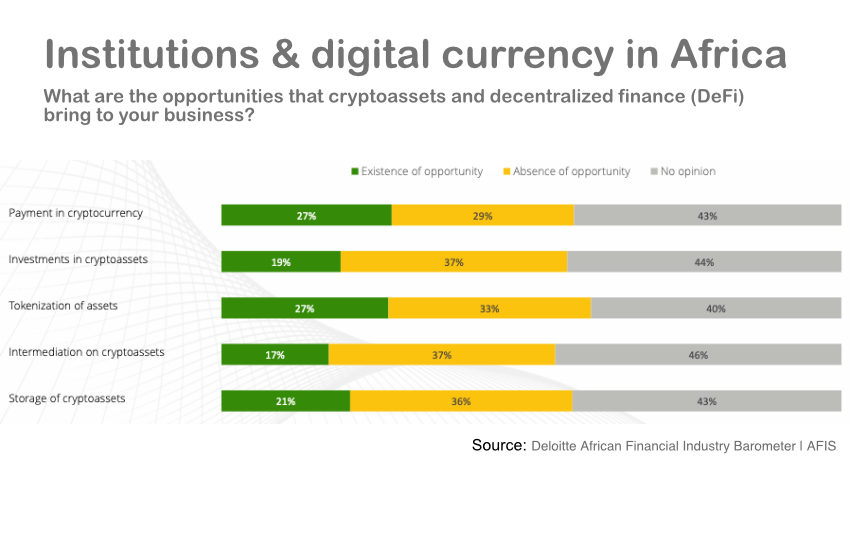

Returning to cryptocurrencies, Africa's focus is different from most developed countries. The main use cases are tokenization and cryptocurrencies for payments. In both cases, only 27% of institutions think they have a chance. However, far more organizations have yet to take a stand. 40% of organizations are concerned with tokenization and 43% are concerned with payments.

Yellow Card, one of the organizations that shared comments as part of the report, is an African cryptocurrency exchange with a presence in 16 countries. While the company's marketing talks about Bitcoin, ETH, and stablecoins, CEO Chris Morris emphasizes the importance of separating USD stablecoins from the rest of the crypto industry. emphasized. He said that “companies across Africa use stablecoins every day for international payments, financial management and inflation hedging.”

The Chainaloss Geographic Report on Cryptocurrency Activity confirms this. Nigeria is the only African country in the overall top 10. However, African countries account for seven of the top 10 most active countries in terms of P2P transaction volume, which includes most stablecoin payments.

Deloitte did not say how many people participated in the survey.