Crypto asset manager Grayscale has made a strategic move to transfer 3,443.1 Bitcoin worth over $175 million to an address associated with the Coinbase exchange.

The latest move was executed in five separate transactions to Coinbase Prime, a platform designed to serve the liquidity needs of financial institutions.

This transfer has generated a lot of interest within the financial and crypto communities, as grayscale is known to have a significant impact on market trends. The company's decision to move such a large amount of Bitcoin to a liquid exchange for potential sale comes at a time when the cryptocurrency market is experiencing a mix of volatility and growth.

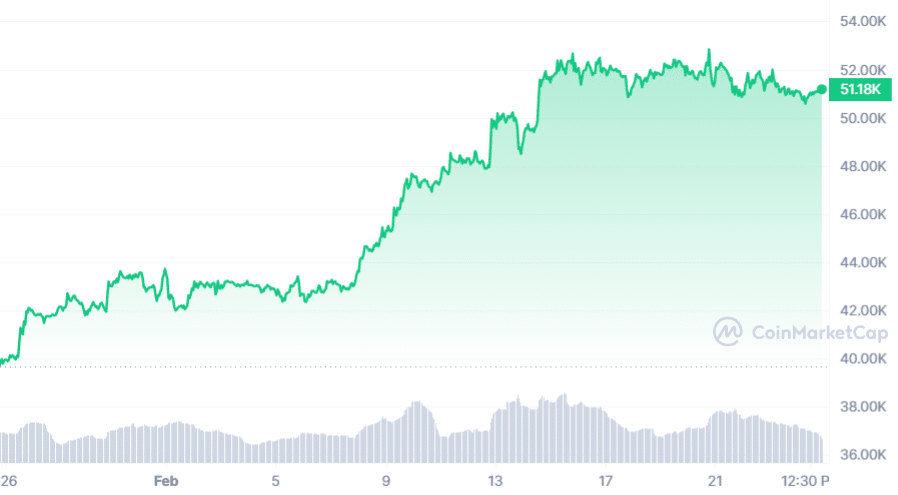

Bitcoin price recently rose 20% in February of this year and remains above $50,000, despite falling only 2.65% in the past three days.

There has been a lot of speculation about the reasons behind Grayscale's recent deals. Some market observers have suggested the move could be part of a strategy to capitalize on recent market gains. This theory has become even more important given the current market rally after investors locked their investments in funds for long periods of time and had particularly attractive liquidation opportunities.

The timing of Grayscale's action coincides with the debate over management fees in the digital asset management space. Grayscale's Bitcoin Trust (GBTC) is known for its relatively high management fee of 1.5%, in contrast to competitors such as BlackRock's IBIT, which currently charges a fee of 0.12%. Plans are afoot to increase this to 0.25% within the year. A few months.

The difference in fees plays an important role in investor decision-making because lower fees typically increase net income in the long run.

Some commentators have linked increased outflow from Grayscale to Genesis activity. suggest The latter's sale of GBTC in Bitcoin may be influencing market trends.

This outlook provides a less bearish outlook on Grayscale's future market impact and suggests that the nature of its sales in Bitcoin may offset the impact of these transactions. Masu.

Following this significant transfer, Grayscale now holds 449,834 Bitcoins, valued at over $23 billion. The company's portfolio extends beyond Bitcoin, with Ethereum (ETH) and Livepeer (LPT) being its second and third largest holdings, respectively.

Grayscale has over $31 billion in total assets under management, which also includes other notable tokens such as Uniswap (UNI), Chainlink (LINK), and Avalanche (AVAX).