New Education Department data presented to lawmakers earlier this month shows that rural areas of the state, including the Northeast Kingdom, received the most benefits from a law that would change how students are counted for statewide education funding. They say they stand to benefit.

For school districts and homestead property tax taxpayers, Act 127 goes into effect for the first time next school year. Passed in 2022, the law would create a competitive playing field among school districts by giving greater emphasis to low-income students, English language learners, and students in rural schools, given the high cost of educating these students. The aim is to equalize the

Each year, towns in Vermont send money collected through property taxes to the state education fund. This fund distributes money to school districts to pay for the majority of the annual school budget approved by each district's voters.

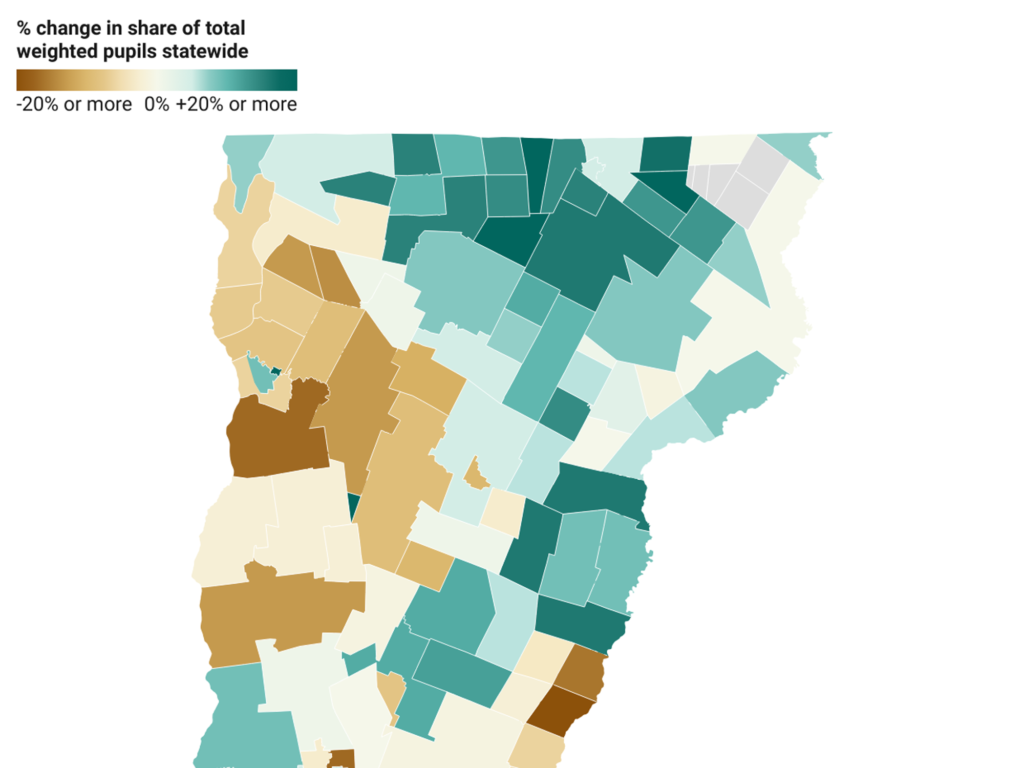

The Education Department recently provided data to lawmakers on how each school district's share of the state's weighted student population has changed as a result of Act 127.

Although complex, this change in weighted student percentages directly impacts homestead property taxes. (Residential property taxes are taxes paid by resident homeowners.) More on this below.

According to the agency's data, many of the school districts with the largest increases in student enrollment are in Caledonia, Essex and Orleans counties in the Northeast Kingdom. Orange County, another rural county, also saw increases in most districts.

Not only are the three Northeast Kingdom counties more rural and sparsely populated than the rest of the state, but each has a median household income below the state average of about $74,000, according to U.S. Census Bureau data. .

In contrast, among districts combined, Addison, Chittenden, Washington, and Grand Isle counties decreased as a weighted share of the state's total student population based on this formula.

In Chittenden County's case, along with the losses, there were also significant gains. Burlington and Winooski increased their share under the new formula. Both districts have higher-than-average proportions of low-income families and English language learners, according to the Education Department and the National Center for Education Statistics.

How to use these infographics

VTDigger created the map above and table below based on data provided to lawmakers by the Vermont Education Agency earlier this month, and also verified that the data is up to date.

You can use these tools to view your local school district and see if its weighted student occupancy is increasing or decreasing based on the new formula. However, there are some caveats.

First, some areas of the state have different school districts for elementary, middle, and high school students, such as local high schools. If there are overlapping districts, VTDigger has chosen to only represent the smaller districts on the map, but the other districts will still appear in the table below. Districts not reflected in the map have an asterisk next to their name in the table.

Second, the three regions of Buhls-Gore, Ferdinand, and Somerset were so small that the pupil weight fraction was less than 0.01%. Although they have been removed from the table, they are still visible in the map, marked as “<0.01%".

Impact of weighted student distribution on residential property taxes

The district's budget raises or lowers the homestead tax rate for the year based on the district's education spending per “weighted pupil.” This calculation is obtained by multiplying the weight assigned to a particular student category by the number of students in that district. Category. (For non-homestead properties, a category that includes corporate-owned properties, rental units, and vacation homes, this is less relevant.) ) — to meet the remaining education spending needs. )

The new student weighting system under Act 127 means that nearly every school district has changed its percentage of the total weighted student population statewide. As a result, school districts across the state have experienced fluctuations in their “tax capacity,” a measure of how much statewide education funds provide to a school district for a given tax rate. Towns that increased as a percentage of the state's total “weighted student” population had higher tax-paying ability, and towns that decreased as a percentage had lower tax-paying ability.

Increased tax ability means school districts receive more funding at the same tax rate, or a lower tax rate at the same funding level. Reduced ability to pay taxes means that school districts either need a higher tax rate to receive the same level of funding, or receive less funding at the same tax rate.

Act 127 included a provision aimed at phasing in these changes by capping the annual increase in each district's housing tax rate to 5% over the next five years. But all school districts in the state will increase their education spending by an average of nearly 15% from the previous year, due to steep increases in employee health costs and the loss of federal funding during the COVID-19 pandemic. is proposed. this year.

These special circumstances will cause every school district in the state to exceed the cap, according to the Education Department's recent calculations. As a result, if this cap remains in place, the tax rate for non-homestead properties will skyrocket.

In recent weeks, lawmakers have been scrambling to remove the 5% cap and legislate a new transition mechanism. Legislation to do this has been approved by both chambers of Congress and will now be on the desk of Gov. Phil Scott, who is expected to sign it.

If passed into law, the new structure would reduce a school district's homestead tax rate by 1 cent per $100 of property value for each percentage decrease in the state's weighted student population. The discount will be reduced by 20% in each of the next five years.

So, for example, the Norwich School District in the Upper Valley was one of the districts that lost the most tax-paying capacity, with its share of the state's weighted student population declining by 19%. The new transition mechanism would reduce the district's pre-CLA homestead property tax rate to 19 cents this year and 15.2 cents next year.

The impact of these changes will be somewhat blunted for about two-thirds of homestead property tax taxpayers whose annual household income falls below the $128,000 threshold set this year. These taxpayers may be eligible for a property tax credit of up to $8,000, depending on their income and property value.

The bill would also allow school districts to amend their budgets if necessary and postpone the annual meeting for consideration by voters until April 15.

Ethan Weinstein and Kristen Fountain contributed reporting.