-

revenue: Increased 2.1% to $710 million, with the CTU segment increasing 11.8%.

-

Operating income: Full-year sales of $150.4 million, an increase of 16.1%. Operating profit decreased by 29.7% in the fourth quarter.

-

Earnings per share: Full-year EPS increased from $1.39 to $2.18. Fourth quarter EPS increased from $0.23 to $0.26.

-

student registration: CTU enrollment increased by 3.2%, while AIUS decreased by 39.3%.

-

dividend: The Board of Directors has declared a fourth quarter dividend of $0.11 per share, payable on March 15, 2024.

-

Stock buyback: The new program allows for share buybacks of up to $50 million starting March 1, 2024.

-

cash position: Ended the year with cash and investments of $604.2 million, up from $518.2 million.

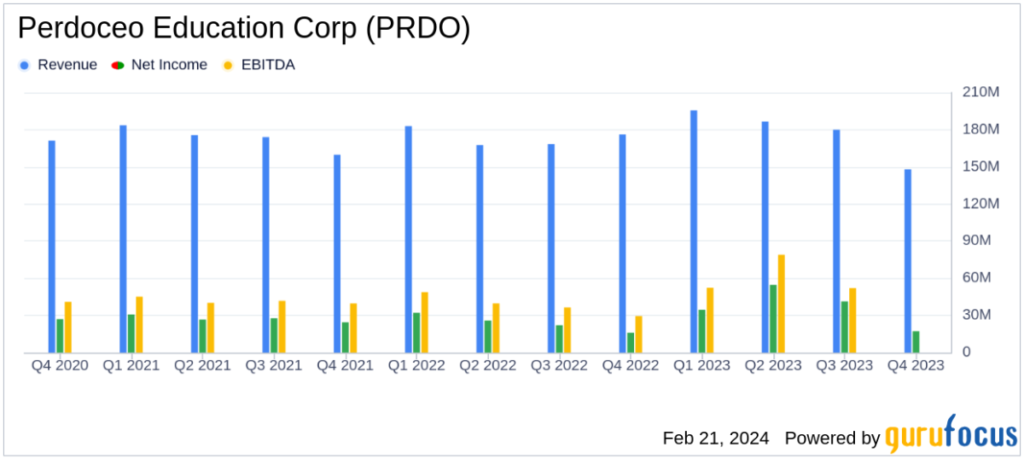

On February 21, 2024, Perdoseo Education Corporation (NASDAQ:PRDO) released its 8-K report detailing its fourth quarter and full year 2023 financial performance. The company is known for its online educational institutions, including American Intercontinental. The university and Colorado Tech reported mixed results, with annual revenue increases offset by fourth-quarter declines.

Annual and quarterly performance

For the full year, PRDO's revenue increased 2.1% to $710 million, driven by an 11.8% increase in revenue from its Colorado Technological University (CTU) division. Operating income for the year improved significantly, increasing 16.1% to $150.4 million, and diluted earnings per share jumped to $2.18 from $1.39 a year ago. Adjusted operating income and adjusted diluted earnings per share also increased by 6.7% and 28.8%, respectively.

However, the fourth quarter was a different story, with revenue declining 16.0% to $147.9 million, primarily due to lower enrollment at the American Intercontinental University System (AIUS). Operating income for the quarter also decreased 29.7% to $15.9 million, and adjusted operating income decreased 40.2% to $19.4 million. Despite this decline, diluted earnings per share for the quarter increased to $0.26 from $0.23 in the year-ago period.

Registration dynamics

Admissions trends showed a bifurcated pattern, with CTU's total student enrollment increasing by 3.2%, while AIUS's total student enrollment decreased significantly by 39.3%. The company attributed the decline in AIUS to short-term operational changes that impacted year-end total student enrollment.

Capital allocation and cash flow

PRDO's Board of Directors announced a quarterly dividend of $0.11 per share, highlighting the company's commitment to returning value to shareholders. Additionally, a new share repurchase program has been approved, allowing the company to repurchase up to $50 million of common stock by September 30, 2025.

Net cash provided by operating activities for the quarter was $13.2 million, a decrease from the prior year period, and capital expenditures decreased 54.2%. The company ended the year in a strong cash position with $604.2 million in cash, cash equivalents, restricted cash and short-term investments, up from a total of $518.2 million a year ago.

For the future

Perdoceo Education Corp.'s management team expressed confidence in its strategic investments in student support and technology that are expected to improve student retention and academic performance. The company's 2024 financial outlook assumes consistent student interest and retention trends, no significant regulatory impacts, and an effective income tax rate of approximately 25.5% for the first quarter and approximately 26% for the full year. It contains.

Investors and analysts are encouraged to review PRDO's entire 8-K filing for a detailed understanding of its financial performance and future prospects. The company also plans to host a conference call to discuss these results and provide further insight into its 2024 outlook.

For detailed information and analysis on Perdoceo Education Corp.'s performance and future outlook, value investors and stakeholders should visit GuruFocus.com.

For more information, see Perdoceo Education Corp's full 8-K earnings release here.

This article first appeared on GuruFocus.