Bitcoin and cryptocurrencies have soared in recent months, leading the Biden administration to declare a “state of emergency” for cryptocurrencies. Ethereum is up 50% in the past year, while XRP is up 35%.

Subscribe now Forbes Crypto Assets and Blockchain Advisor And ahead of next year's historic Bitcoin halving, we will “unveil the blockchain blockbuster products that can expect profits of over 1,000%”!

Price passes $50,000 per Bitcoin, once again making it a $1 trillion asset, pushing Ethereum, XRP and the entire crypto market above $2 trillion (claims 'this time will be different' thanks to impending earthquake) some people).

Now, a leak has revealed that the controversial central bank digital dollar may be closer than expected, but Wall Street giant JP Morgan has announced that its institutional investor Thanks to its appearance, attitudes towards Bitcoin and the cryptocurrency exchange Coinbase suddenly changed.

Bitcoin's historic halving, which is expected to cause turmoil in cryptocurrency prices, is just around the corner. Sign up for free now crypto codex—Stay ahead of the market with our daily newsletter for traders, investors, and anyone interested in cryptocurrencies.

“We believe this rise in Bitcoin is contributing to the improvement of the Spot Bitcoin ETF.” [exchange-traded funds] That is driving the price of Bitcoin higher, and other tokens as well,” JPMorgan analysts led by Kenneth Worthington wrote in a note to clients. coin desk.

The arrival of the much-anticipated Bitcoin Spot ETFs on Wall Street last month saw asset managers led by BlackRock and Fidelity amass massive amounts of Bitcoin, driving the price of Bitcoin up 25%.

This week, nine new Bitcoin ETFs received approximately $630 million in inflows in just one day, bringing their total assets under management to over $10 billion.

“Given the acceleration of inflows into Bitcoin ETFs in recent days, as well as the significant price increases for Bitcoin and now Ethereum ETH, we believe that the rise in crypto prices is not only maintaining activity levels, but improving. As seen, Coinbase's rating is returning to “neutral” and Coinbase's earning power that we pay attention to [the first quarter of 2024]”Worthington wrote.

Coinbase, which serves as a Bitcoin custodian for the majority of Bitcoin ETFs, has seen its stock rise more than 400% since hitting an all-time low in January 2023.

Sign up now crypto codex—Free daily newsletter for those interested in cryptocurrencies

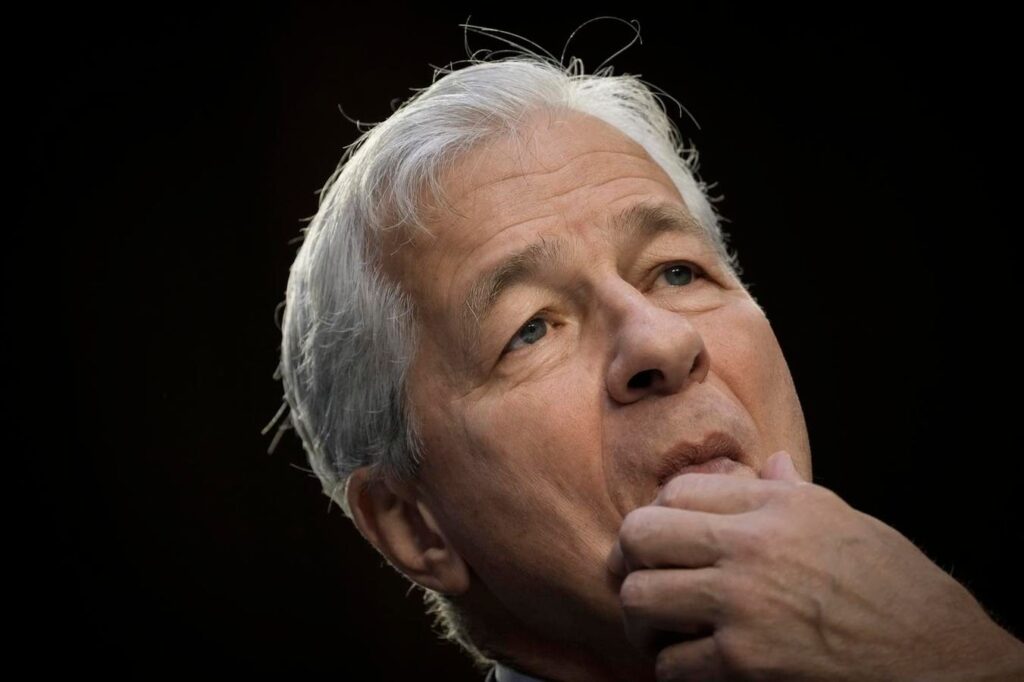

Despite JPMorgan analysts raising their outlook for Coinbase, the bank's CEO Jamie Dimon remains adamantly skeptical of Bitcoin and cryptocurrencies, and has recently The coin's mysterious creator, Satoshi Nakamoto, predicted that it might actually destroy the technology.

“I think there’s a good chance that… once we get to that 21 million Bitcoins, [Satoshi Nakamato] You're going to come in there and laugh hysterically and be quiet and all your bitcoins will be wiped out,'' said Dimon, who is no longer talking about bitcoin. CNBC On the occasion of the World Economic Forum (WEF) held in Davos.

follow me twitter.