and Bitcoin With prices still above $60,000, the crypto market remains hot despite the recent pullback. If you want more exposure, you can of course buy Bitcoin directly, or other cryptocurrencies for that matter.

But there are other ways to increase your exposure to cryptocurrencies, even through traditional stocks. Two crypto stocks in particular are poised for explosive growth in 2024 and beyond.

This stock is betting on cryptocurrencies for the masses

Most people think that PayPal (NASDAQ:PYPL) As a payment company. With over 400 million users, there's a good chance you've personally used his PayPal to buy something online or send money to friends and family. . This remains the backbone of the company. Users trust the company to provide a safe, secure and reliable way to conduct digital transactions. If something happens that you didn't intend, like buying a fraudulent item or sending money to the wrong company, PayPal can step in and fix the error.

In 2013, PayPal gambled $800 million by acquiring peer-to-peer money app Venmo. Venmo users can send and receive money from anyone through their smartphones with just a few clicks. The service is part of a megatrend called financial democratization, which gives ordinary people more control over their money.

PayPal's acquisition of Venmo turned out to be a great business decision. In 2013, Venmo users used the app to transfer just billions of dollars between themselves. But last quarter, nearly $70 billion was transferred through Venmo's platform. The share of cryptocurrency payments in that volume is increasing. That's because the company introduced cryptocurrency payments last year. Venmo allows anyone to buy and trade a variety of cryptocurrencies, including Bitcoin.

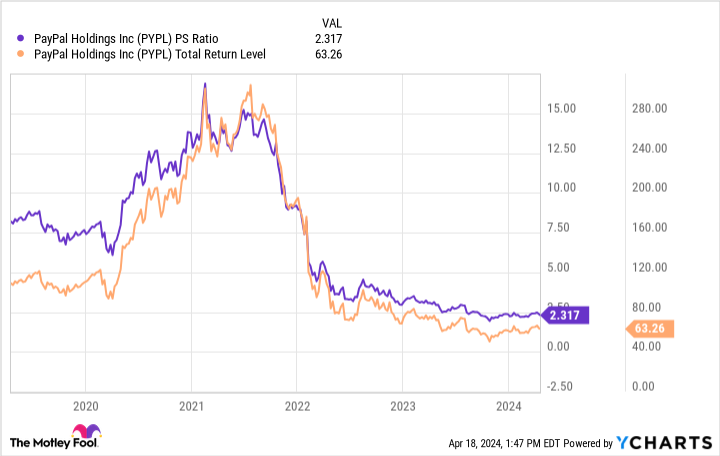

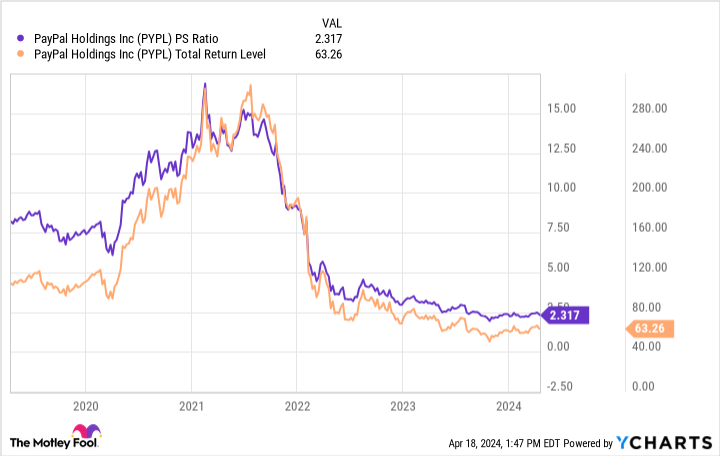

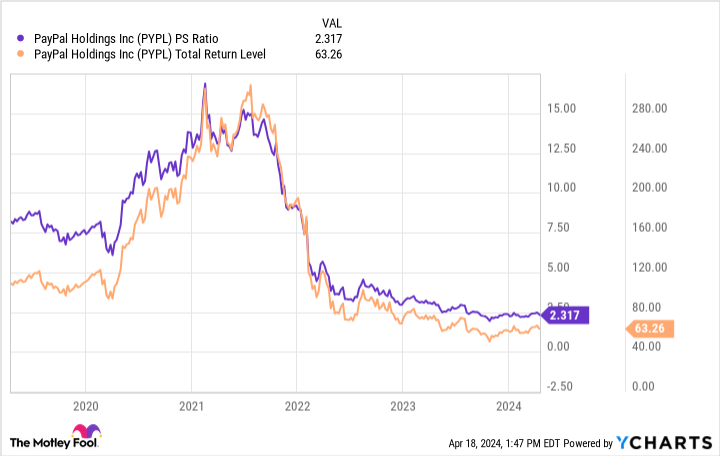

PayPal's traditional business has shrunk in recent years, sending the stock at a steep discount to its historical valuation. Virtual currencies have the potential to become a new pillar of growth. After all, few companies have the existing 400 million strong user base that can seamlessly connect to the crypto ecosystem. It will take time for cryptocurrencies to become a meaningful driver of PayPal's growth, but few companies around the world can match its potential. PayPal has already achieved massive scale. If it can bridge the gap between its huge user base and the rapid rise of cryptocurrencies, the stock could skyrocket, especially given its depressed valuation.

Go all-in on blockchain with this crypto stock

Similar to PayPal, block (NYSE:SQ) The stock also has exposure to cryptocurrency payments. However, unlike PayPal, there are multiple ways to win here.

Block has its own Venmo competitor called Cash App. The app has about 50 million users, while Venmo has about 70 million users. Similar to Venmo, anyone can use Cash App to buy, sell, and trade various cryptocurrencies. In this respect, Block offers similar cryptocurrency exposure as PayPal.

But the block has some more There is also a crypto-related business line. For example, the company's software divisions, TBD and Spiral, are building open source tools and ecosystems to accelerate the development and adoption of cryptocurrencies. Meanwhile, the company's Square platform, which allows merchants to quickly and easily adopt mobile payments, now accepts cryptocurrencies as a payment method. Even the company's music streaming app, Tidal, is exposed to cryptocurrencies. Many companies are experimenting with using blockchain for copyright verification and transparent payments. If this trend catches on in the music industry, Brock will have a front row seat.

The best news is that, like PayPal stock, Block stock is currently on sale. The stock is currently valued at just twice sales. A few years ago, the company's price-to-sales multiple was more than 10x his. Recently, the company's growth has slowed and its profitability is no longer reliable. But if you believe in crypto growth over the long term, few stocks offer more direct exposure than Block.

Where to invest $1,000 right now

When our analyst team has a stock tip, it's worth listening. After all, the newsletter they've been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks PayPal made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor will return as of April 15, 2024

Ryan Vanzo has a position in Bitcoin. The Motley Fool has positions in and recommends Bitcoin, Block, and PayPal. The Motley Fool recommends this option: His June 2024 $67.50 Short Calls on PayPal. The Motley Fool has a disclosure policy.

2 Potentially Explosive Crypto Stocks to Buy in April was originally published by The Motley Fool